Tasmania remains as best performing Australian property market, says expert

Despite the downward trend seen in most markets across Australian states and territories today, Tasmania has sustained its economy, emerging as the top property market in the recent years. How are other states faring compared to the ‘best performing market in Australia’?

Since 2014, Tasmania slowly made its way up to becoming one of the biggest economies in the country, even after going through a state recession as a result of the global financial crisis ten years ago.

To continue reading the rest of this article, please log in.

Create free account to get unlimited news articles and more!

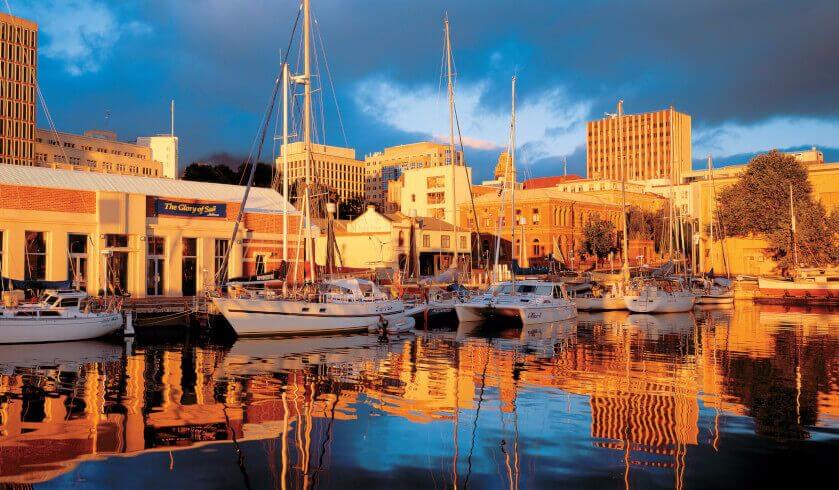

Its capital Hobart has also proven that it has the fundamentals and growth drivers that can be found in primary metropolitan markets such as price growth and good yields.

According to Propertyology’s Simon Pressley: “Hobart is still growing. Sydney and Melbourne, their prices are retreating. We know that their growth is finished, which means—history repeats itself—we are several years before their growth cycles start again.”

Based on the prosperity in Tasmania, the capital cities of New South Wales, Victoria and Queensland may have a long way to go, he said.

Tasmania

While there are people who argue that Hobart has had its time in the spotlight and investors should be moving on and finding the next hotspot, Mr Pressley believes that the city is still among the best investment locations in Australia.

The market cycle influenced by economic development, good leadership and diverse demographics has helped the state thrive through the years.

In fact, it could still very well be the best performing market in the country right now.

The property expert explained: “It will come to an end at some point, but still, we can't see that yet. The broader Tasmanian economy, I would suggest is the single biggest success story in Australia since the onset of the global financial crisis 10 years ago.”

“That state was in recession, it was on its knees for a good four or five years. Now, its economy is as good as New South Wales and Victoria. I don't think the nation's done enough to pat Tassie on the back for the wonderful job it's done.

“Some other states that have been quite underwhelming could learn a lot from tapping into the Tasmanian government and saying ‘What did you do?’ because it's worked,” he highlighted.

As a buyer’s agent, Mr Pressley advised investors to stay in the market but avoid buying any more.

After all, a flat market is set to benefit the buyer, but a hot market will benefit those who already have their foot up the ladder.

Victoria

Meanwhile, the state of Victoria, particularly its capital Melbourne, is going sideways after years of unprecedented property boom.

While the local economy is still strong, it’s undeniable that the good market cycle has passed.

According to Mr Pressley: “Melbourne and Sydney are very similar. They both still have strong economies, they both have an increasing volume of new supply already hitting the market, but I think there's a couple of years of that still to come through.”

Despite its similarity to Sydney, the capital of New South Wales, Melbourne is deemed less fragile due to the continuous population growth across the city, with new residents coming from overseas or other states and territories.

Moreover, Melbourne offers more affordable alternatives to the New South Wales capital as well as good potential for significant returns.

Nevertheless, investors are advised to be careful when investing in the capital city because, at the end of the day, it’s undoubtedly reached the softening phase.

“I'm less concerned about Melbourne than what I am about Sydney, but I wouldn't be investing in either for quite some time,” the property expert said.

New South Wales

The most concerning thing about the property market in New South Wales, particularly in its capital Sydney, is its lack of affordability and the apparent oversupply, according to Mr Pressley.

Median house price sits at over $1.1 million, and that’s after the capital city has seen a huge 4.5 per cent drop in house prices, the largest annual fall since 2008.

Meanwhile, new listings may be down by 13.1 per cent to 5,601 but the total number of listings, which sits at 26,103 in June, is 21.7 per cent higher than the previous month, reflecting the difficulty in selling stocks.

Mr Pressley said: “The high vacancy rates are not alarming but it's not going in the right direction.”

Like Melbourne, Sydney’s economy remains strong so those who are already in the capital city’s property market haven’t got a lot to worry about. Despite rampant doom-and-gloom headlines, the market will not be crashing any time soon.

As long as you’re not paying more in holding costs than you’re receiving in yield, then the property expert believes that you are in a good place as an investor.

However, you need to be realistic about your expectations, according to Mr Pressley. After all, Sydney is a softening market and it would take some time before the cycle puts it back up on top.

“You can't control what the asset value will be and I think you're some years away before you'll see some growth, but if it's not costing you much to hold that, that's investing in property,” he highlighted.

Queensland

As Melbourne and Sydney continue to go on a downward trend after a property boom, the Queensland capital Brisbane is starting to emerge as the most likely to be the next property hotspot. However, experts advise investors to be more careful about picking a location for their asset.

As the third most populous city in Australia, Brisbane usually comes up to investors’ minds by default, but based on market research, the capital city has not changed all that much since a decade ago.

While the city’s market has not been going backwards in the last 10 years, the growth that it has achieved over time is nothing short of underwhelming.

According to Mr Pressley: “The economy's not terrible but it's uninspiring. The state government debt is the highest in the country and Queensland, believe it or not, has more assets than New South Wales. It’s also only half the size in population."

“Is it a bad decision to invest in Brisbane or regional Queensland? No, but I would just say to investors: Don’t just adopt your default behaviour and pick Brisbane as the next opportunity up the road; there’s a whole country out there to look at,” he added.

Instead of following the crowd, make sure to base your decision on thorough research and due diligence. Every investment decision must be influenced by your personal goals, financial capabilities and limitations.

Take into consideration the government plans for growth and development, past and present capital growth rates and the level of infrastructure and amenities, including roads, public transport, hospitals and schools. Demographic information, such as population growth and local residents rent proportion, will help you determine the potential growth in the area.

Mr Pressley said: “The fundamentals of Brisbane are solid and they have been for a decade. It’s a nice city but nice doesn't make things grow.

“There needs to be something different about it to really, really draw people there. Whether that’s attractions to drag someone to live there, or whether that’s attractions to motivate people to create a different business.

“We’re in a world-wide tourism boom. We have been since 2012. Brisbane hasn’t done anything to take advantage of it. At some stage, someone will get the message and they'll do the things they need to kickstart that economy. The underlying fundamentals are already strong," according to him.

Tune in to Simon Pressley's episode on The Smart Property Investment Show to know more about the current state of the Australian property market and the best spots to invest in right now.