Do banks pay attention to borrowers’ BNPL debts?

The Australian Prudential Regulation Authority (APRA) has clarified whether home loan providers should include debt accrued through buy-now-pay-later schemes when assessing a borrower’s debt-to-income ratio.

APRA has finalised amendments to its prudential framework that were proposed in November 2021, following a consultation process with industry participants. The new measures will come into effect on 1 September 2022.

To continue reading the rest of this article, please log in.

Create free account to get unlimited news articles and more!

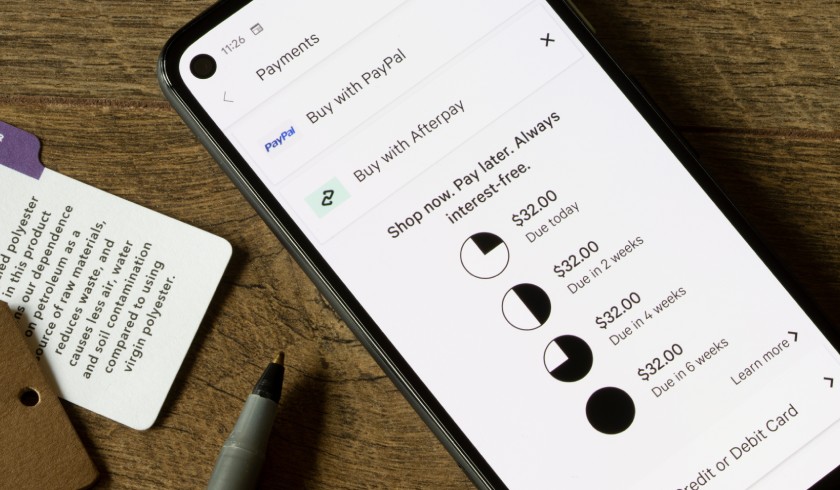

Among the macro-prudential policy credit measures the regulator handed down was a clarification on whether debts accrued through buy-now-pay-later platforms (BNPL) such as Afterpay, Zip, and Humm should be included in assessing the debt-to-income (DTI) ratio of mortgage applicants. Whether government higher education HECS-HELP loan debts should be included in DTI assessments was also a point on which lenders requested clarity.

The regulator confirmed that DTI should take stock of “the ratio of the credit limit of all debts held by the borrower, to the borrowers’ gross income”, and they have specified that BNPL and HECS-HELP loans fall into this category.

Many borrowers may already have had this information taken into account in their mortgage applications, but the regulator said this clarification would “ensure a consistent approach is taken across industry”.

APRA chair Wayne Byres noted that the aim of the new macro-prudential policy requirements was to strengthen the transparency, implementation and enforceability of future policy responses to systemic risks.

BNPL schemes have been increasingly growing in popularity in Australia, with approximately 30 per cent of the country’s residents having used a BNPL service in the past year.

And unlike most of the other debt that Australians accrue, BNPL is not regulated under the National Credit Act – a legal loophole allows them to skirt this law because they do not charge interest on repayments. Instead, BNPL providers are expected to follow an industry code of conduct.

The new requirements require lenders to have systems in place to limit growth in higher-risk residential mortgage lending, such as loans at high debt-to-income multiples or high loan-to-valuation ratios.

In a letter to authorised deposit-taking institutions, Mr Byres emphasised the importance of lenders actively managing the risks within their loan portfolios.

“In the current environment, with high household indebtedness and rising interest rates, it’s essential for banks to prudently and proactively manage risks in residential mortgage lending,” Mr Byres said.

“APRA expects lenders to closely monitor housing lending risks to ensure that aggregate portfolio risks remain within their risk appetite and that standards for new lending remain prudent.”