Worrying about your property? The numbers are in your favour

Investors who are worried about getting into the market are being advised that the worst-case scenario is better than doing nothing at all, with record-low interest rates making it easier for investors to get ahead.

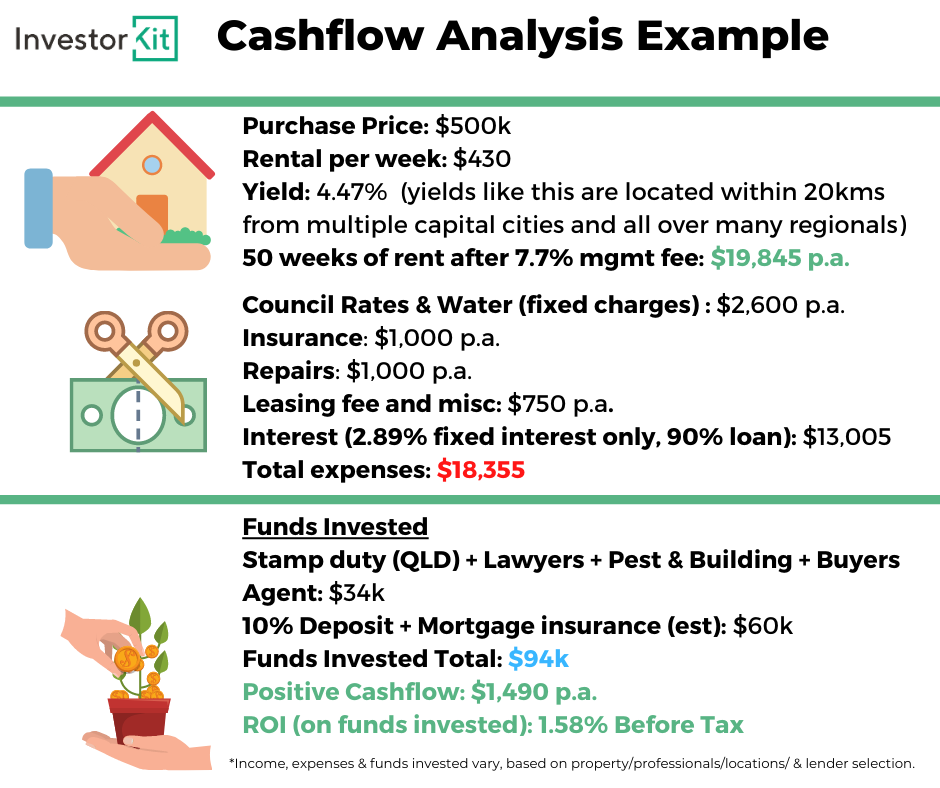

During a conversation with Smart Property Investment, InvestorKit director Arjun Paliwal explained how an investor can purchase property in today’s market and end up well ahead of bank returns.

“Among all this panic because interest rates are so low and retail yields are healthy, you can purchase a property within 20 kms from one of our major CBDs. With the positive cash flow, you’re still about 2.79 per cent return on your money,” Mr Paliwal explained.

The property investor highlighted how conservatively an investor can double the rate of return from the highest-end savings accounts offered to investors and even beat the numbers in an offset account.

“If you had funds sitting in an offset account with today’s interest rates of between 2.19 and 2.6 per cent, you’re technically losing money by having money in your offset account.

“Investing today in some markets is so positively cash flowed because of where we are [interest rate-wise], that even among all this panic, many people will not need to list their properties because of numbers like this,” Mr Paliwal said.

The property researcher highlighted that investors will still get ahead without taking into account capital growth or tax incentives such as depreciation of the asset.

He also urged investors to invest for their worst-case scenario, which is a couple of years without capital growth and relying on rental yields.

“You can invest safely as your worst case. The key is not make this your target but look at it as a worst case.

“If I have these types of numbers, then my worst case is looking pretty good,” Mr Paliwal said.

In order to do this, investors are advised to focus on rental yields as part of their analysis.

“You’re not buying in areas full of rental stock, you’re not buying in areas of available lands, you’re not buying in areas where rental stocks are trending upwards and you’re not buying in apartments which has the risk of more supply.

“If you’re doing that due diligence on the rental side, you can make your worst case better than doing nothing at all.

“Then all the other analysis we do around capital growth, sea change, tree change, where we see capital markets bouncing back, that’s all plus. It doesn’t need to be the worst-case scenario or your fingers cross, that’s on top of your worst-case scenario,” Mr Paliwal concluded.