Interest rates, house prices and why we’re living through the greatest period in world history!

Blogger: Troy Gunasekera, national manager, The Property Club

Interest Rates:

Firstly, the most common question we have received through this week at Property Club, has been about what interest rates might or might not do!

Currently, our finance broker network has the following best interest rates available:

1 Year Fixed: 4.89%

3 Year Fixed: 4.99%

So what does that tell us about what interest rates will do the next few years?

If you can get finance at 4.99% (pretty much the equivalent to most people’s current variable rate) for three years; do you think that there would be much of a chance of the variable rates going to 6% and staying there for three years? Not likely!

Don’t just take my word for it, the Chief Economist of Westpac, Bill Evans responded to the results of the RBA meeting this week, (in part) with the following comments:

• As expected the Reserve Bank Board decided to leave the cash rate unchanged at 2.50%

• The Bank is clearly careful to emphasise that there is no case for higher rates

• Westpac has been anticipating an extended period of steady rates. This scenario is now confirmed in the Governor’s following statement; We do not expect rates to be lowered before the second half of 2014 when many of the apparent puzzles in today’s statement will be resolved. Our current view is for a move in august to be followed up with a further move later in the year.

There you have it, clear and logical. Now let’s see what the year brings!

Housing prices:

To begin with a positive; house prices increased over the past year - nationally, being up around 10%.

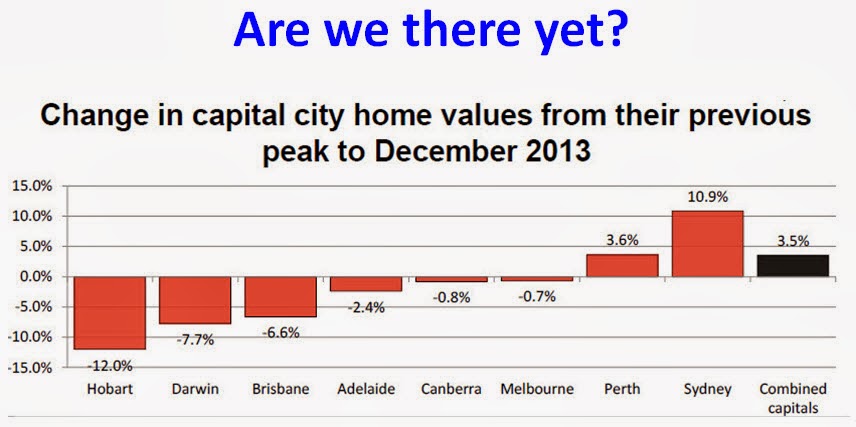

This has provoked discussions about fears that house prices could be going too high, too quickly. Of course in pockets around the countryside, there are areas where first home buyers will struggle to get into the market. However, as you will see from the graph below, house prices nationally are only 4% above their previous peak, with Perth and Sydney the only cities to be above.

The graph is logically showing that house prices are not increasing at a crazy rate, as when put into perspective with history, they aren’t that much over the long-term rate, with the obvious exception being Sydney.

And then, the increase in housing loan approvals over the past six months has prompted the following comments from St George economists Hans Kunnen and Janu Chan;

“Rising house prices, low interest rates and robust population growth suggests that residential housing activity should remain elevated.”

“Residential investment should make a solid contribution towards economic growth in 2014.”

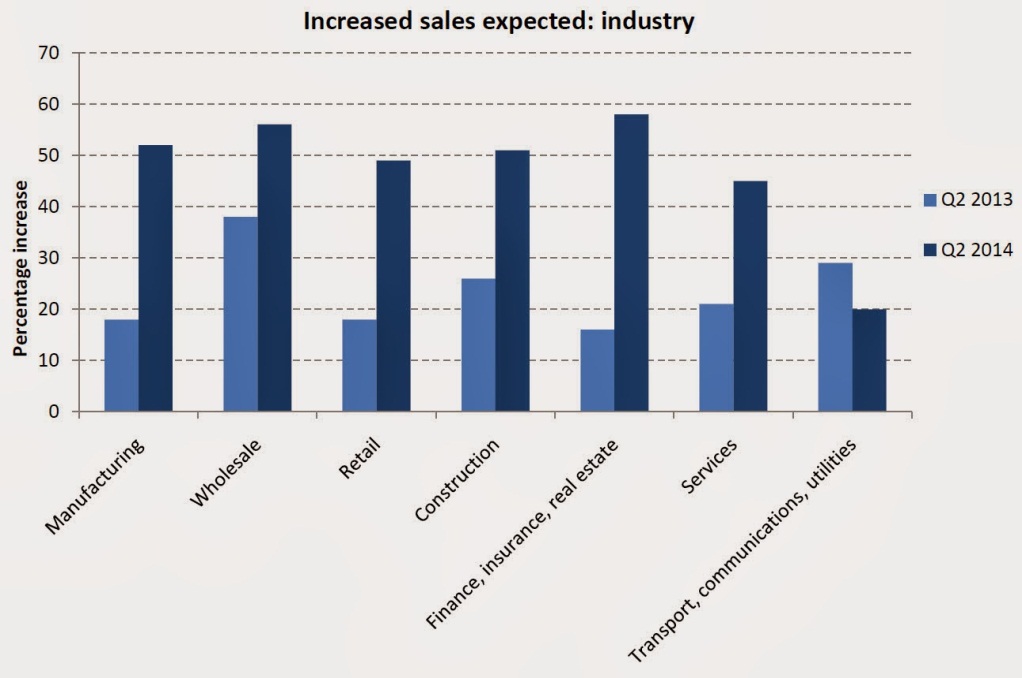

The respected commercial firm Dun & Bradstreet published the following very positive results of their quarterly survey into business conditions:

• “The upswing in the economy continues to unfold, although the only moderate levels for expected employment and capital expenditure suggest a fully-fledged upswing may still be a few months away,” said Stephen Koukoulas, Economic Adviser to Dun & Bradstreet

• For the RBA, the Business Expectations Survey is good news. The economy is clearly responding to an easy monetary policy and the lower Australian dollar

Are we living through the greatest period in world history?

An article on the internet, 50 Reasons why We’re Living Through the Greatest Period in World History, has some very applicable points for Australia, even though it’s based on America. Some summary points are below:

1. Life expectancy at birth was 39 years in 1800, 49 years in 1900, 68 years in 1950, and 79 years today. The average newborn today can expect to live an entire generation longer than his great-grandparents could!

2. According to the Federal Reserve, the number of lifetime years spent in leisure, i.e.: retirement plus time off during your working years, rose from 11 years in 1870 to 35 years by 1990. Given the rise in life expectancy, it's probably close to 40 years today. Therefore, the average American spends nearly half his life in leisure. If you had told this to the average American 100 years ago, that person would have considered you wealthy beyond imagination.

3. You need an annual income of $34,000 a year to be in the richest 1% of the world, according to World Bank economist Branko Milanovic's 2010 book ‘The Haves and the Have-Nots’. To be in the top half of the globe you need to earn just $1,225 a year. For the top 20%, it's $5,000 per year and you enter the top 10% with $12,000 a year. To be included in the top 0.1% requires an annual income of $70,000.

Pretty good points to keep in mind, wouldn’t you say? Click here to read the whole article 50 Reasons We're Living Through the Greatest Period in World History

If you have specific questions related to property markets, or want to learn more about the fundamentals of property investing, please email me directly!

Happy Investing!

About Troy Gunaskera Troy Gunasekera is the National Manager of The Property Club, Australia’s largest independent property group guiding members of all ages to become financially independent through investing in property.

Troy Gunasekera is the National Manager of The Property Club, Australia’s largest independent property group guiding members of all ages to become financially independent through investing in property.

With his wife, Troy has an impressive portfolio of properties worth over $5m diversified across Australia. His own investments are the result of his continual research into the latest developments in property finance, interest rates and property markets Australia wide.