Will your credit card derail your mortgage application?

From the Financial Ombudsman, under their “Responsible Lending Conduct Obligations and Maladministration”, it states: The responsible lending obligations require reasonable inquiries to be made about the consumer’s financial situation.

What does that look like in real life?

Financial institutions now will go through your statement line by line and compare your spending to the living expenses declaration form that you have submitted.

Some entries are more weighted than others. For example, if there are a large number of entries that relate to alcohol, Ozlotto, Casino etc you are less likely to get a loan because you pose a higher risk.

The same can be said for high recurring monthly expenses at a pharmacy or chemist.

So, apart from the standard loan and credit information you provide the bank, consider the following:

Childcare and/or school fees

If you have children, you’ll need to provide details about any childcare fees or regular school fees you have to pay. These can also include fees for school uniforms and additional school activities.

Medical expenses

If you have any regular medical expenses such as those for prescriptions or ongoing medical care, lenders will want to know your monthly spend.

Entertainment

In this category, lenders will ask you to provide information on the amount you would typically spend on entertainment and leisure. This includes both activities and discretionary items such as alcohol.

Other

If you have any other regular monthly expenses that don’t fall into the categories listed above, you’ll want to list them here.

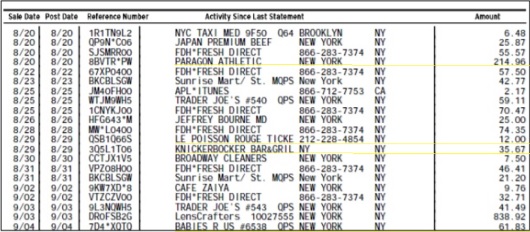

Example: Credit card statement data

Let’s have a look at the following example and note how the creditors would view the entries. You can do this too; grab last month’s statement and go through it line by line so you know what the banks are looking at:

- Paragon Athletic at $214.96 – If this is a recurring payment they may class that as an ongoing debt that could impact your serviceability

- Le Poisson Rouge Ticket at $12.00 – If they can see you are a steady theatre goer, they will adjust your living expenses to reflect this

- KnickerBocker Bar and Grill – If they see you eat out most nights it will impact your living expenses

- Babies R Us at $61.83 – If there are a lot of new baby related expenses they may take that as an additional dependant that impacts your serviceability

You don’t have to stop living. Instead, one idea is to draw cash out of the ATM to pay for things like concerts or the kids school holiday program.