MoneyBRAINS Case Study: Insights into YOUR finance position INSTANTLY

Promoted by Confidence Finance.

How do smart property investors prepare for a housing downturn? The shift in focus usually turns to risk management. This usually comes down to three key points:

- Knowing your finance & risk position clearly – it’s really what you don’t know that can hurt you the most.

- For example, it is important to know when their interest only terms expire, what rates may do & how your cash flow position may change.

- Understanding how much ‘buffers’ you should have in place

- Buffers are your safe guard for cash flow changes & risks materialising in your portfolio. The appropriate buffer size is different for different households. Having ‘enough to sleep at night’ may be great for the mind but isn’t a good risk management plan.

- Having buffers in place

- Your risk buffers can come from two sources: your ongoing savings (cash flow) and your funds that are easily accessible (stock of funds).

Case study:Jim & Joanne

Jim & Joanne have been active property investors over the last 5 years. They have grown a 5 property investment portfolio worth $2.5 million at an 80% loan to value ratio on interest only repayments. Their portfolio earns a 5% investment yield ($100,000 p.a). They earn $150,000 gross between them, have a $6,000 credit card, spend $4,500 per month on expenses and $500 per week on rent. They have one young child & $30,000 in cash savings

Given market & lending conditions, Jim and Joanne have altered their investment strategy in 2018 to focus on risk management and protecting what they already have.

Step 1: Knowing Jim & Joanne’s true finance & risk position.

Jim and Joanne use MoneyBRAINS technology to instantly provide a complete summary of their financial position. After spending 5 minutes inserting their details into the technology, MoneyBRAINS automatically provides them the following detailed information:

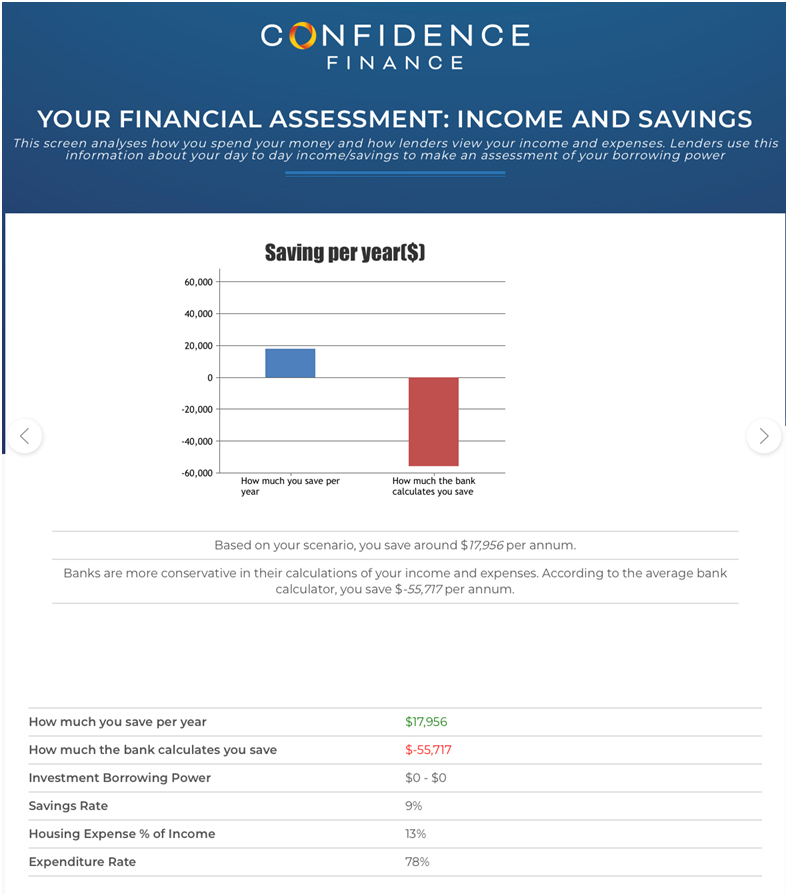

- Although they are saving money from their incomes every year, conservative bank calculators will consider Jim & Joanne as ‘overleveraged’.

- This means they cannot refinance their existing loans and are unlikely to be able to extend their interest only terms.They cannot access additional funds to grow their portfolio at this time.

- MoneyBRAINS also provides a breakdown of their household budget goes (spending, savings, housing).

Step 2: Calculating the appropriate buffer size

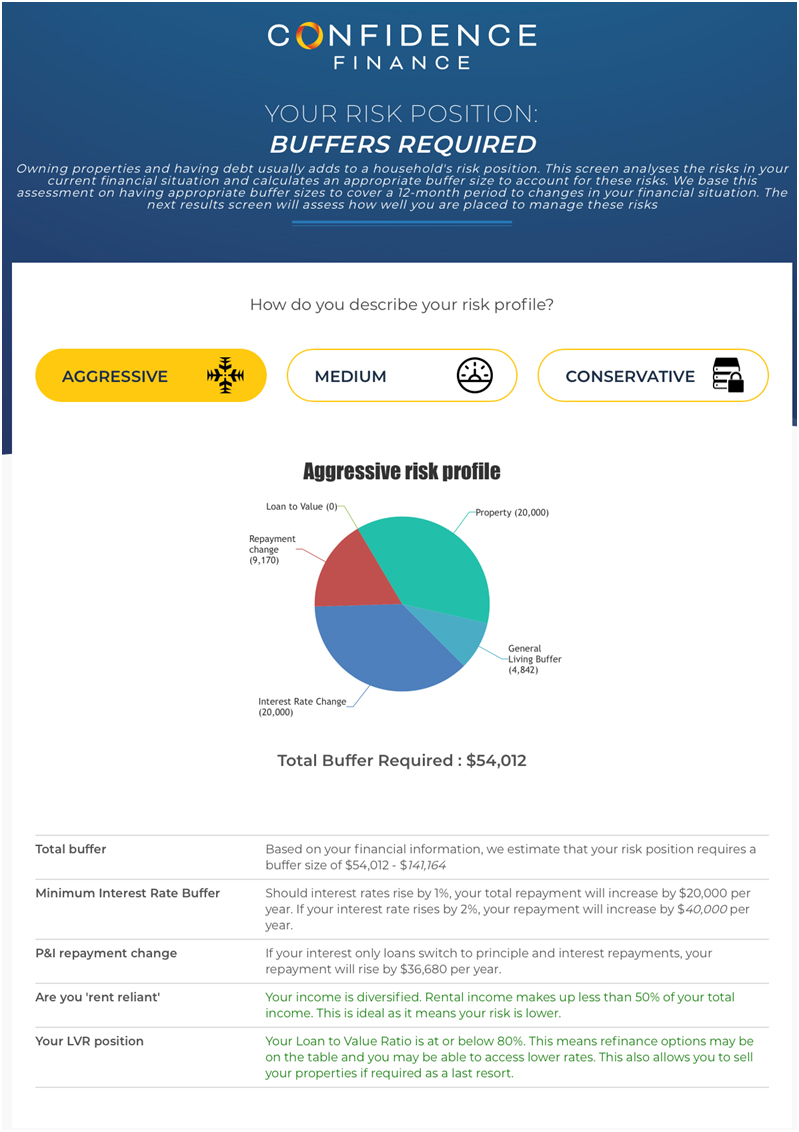

With a better understanding of their current financial information, Jim & Joanne then consider what the appropriate buffer size is for their household.

MoneyBRAINS technology provides users instant calculations for appropriate buffer sizes. The technology accounts for each individual household’s financial position and adjusts the buffer size accordingly. The specific risk factors include Jim & Joanne’s debt, incomes, expenses, repayment type, number of properties, loan to value ratio position & reliance on investment income. That is, MoneyBRAINS provides a holistic analysis of Jim & Joanne’s risk position covering a wide range of risk factors. The technology also allows for different risk appetites to be considered.

In Jim & Joanne’s case, as an ‘overleveraged’ property investor, they will need to hold higher than average buffers to account for their portfolio risk. MoneyBRAINS tech suggests a household buffer size of between $54,000 to $141,000 (depending on risk profiles).

Step 3: Having the buffers in place

With the above information now on hand, Jim & Joanne now consider how they can come up with these buffers.

With the ability to generate ongoing savings & safe employment income, Jim & Joanne consider their ongoing income generation as part of their risk management plan.

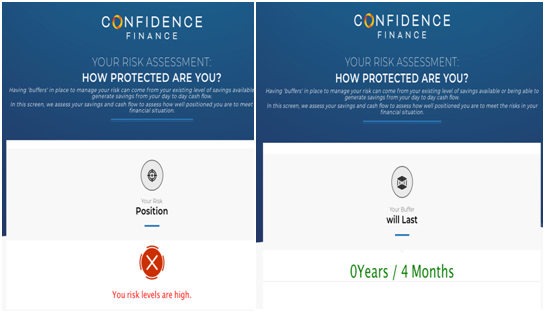

MoneyBRAINS technology helps them realise their ongoing savings per year is only around $18,000 per year, not enough to account for their high levels of risk. Finally, MoneyBRAINS summaries Jim & Joanne’s risk position into a ‘high category’. If changes to economic & financial circumstances begin to eventuate, Jim & Joanne will only be buffered for around 4 months. Furthermore, they realise they are unlikely to be able to extend their interest only terms and that the change in repayments will impact their cash flow by around $36,000 per year.

Jim & Joanne better understand their position &use this information to expedite their savings plan and build resilience to their household balance sheet over the next 6-12 months.