New bank hits the market, set to offer home loans

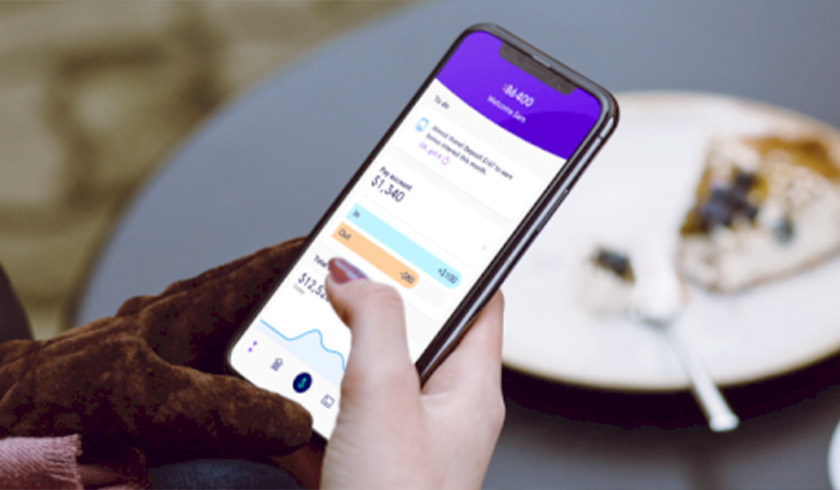

Digital neo-lender 86 400 has been granted a full authorised deposit-taking institution licence by APRA. A neobank or neo-lender is a financial institution that is entirely digital – that is, does not have a physical branch network.

This means the lender can demonstrate it can meet the full prudential framework and is ready to commence banking business.

As such, 86 400 has said it will offer home loans to customers in the near future.

Further, it will launch transaction and savings accounts once its customer-facing app goes live in the Apple and Google app stores within the next month.

86 400 CEO Robert Bell revealed that the bank will be rolling out its mortgage products in the next two to three months. It will be relying on a mortgage broker network to penetrate the market.

“We are focusing entirely on mortgage brokers and that is how we will start our mortgage product launch. With the number of people that go through mortgage brokers, it is the obvious place to start,” he told Smart Property Investment’s sister publication, The Adviser.

“We don’t think anyone has really solved a direct digital home loan yet – it will probably happen in the future – but we see brokers as absolutely critical to our success and that is why we’re starting with brokers.”

You can read the full interview with Mr Bell here.