Why the Sydney and Melbourne Markets will Recover Sooner Than Most Predict

There is a lot of negativity at the moment when it comes to housing. It’s fair to say confidence is low.Nonetheless, at Confidence Finance, we believe that a major housing market crash (25%+) is highly unlikely. In fact, we believe the recovery will be sooner than most think, with prices likely to begin rising again by 2020 (albeit slowly).

We break down why below:

The Economy is very strong:

Australia’s two major economies are in the BOOM phase of the business cycle.

GDP growth jumped to 3.4% in the June 2018 QTR, unemployment has now fallen to 5% on the back of multiple years of record employment growth, interest rates are likely to remain low for a good while yet, the population is growing & infrastructure investment is at record highs.On the back of all of this good economic news, the federal government will soon to deliver Australia’s first surplus in 10 years! The NSW & VIC governments are already in relatively large surplus positions too.

In short, more people, more jobs, more infrastructure & more investment are transforming Sydney & Melbourne into BOOMING economies.

The Household Sector will prove resilient:

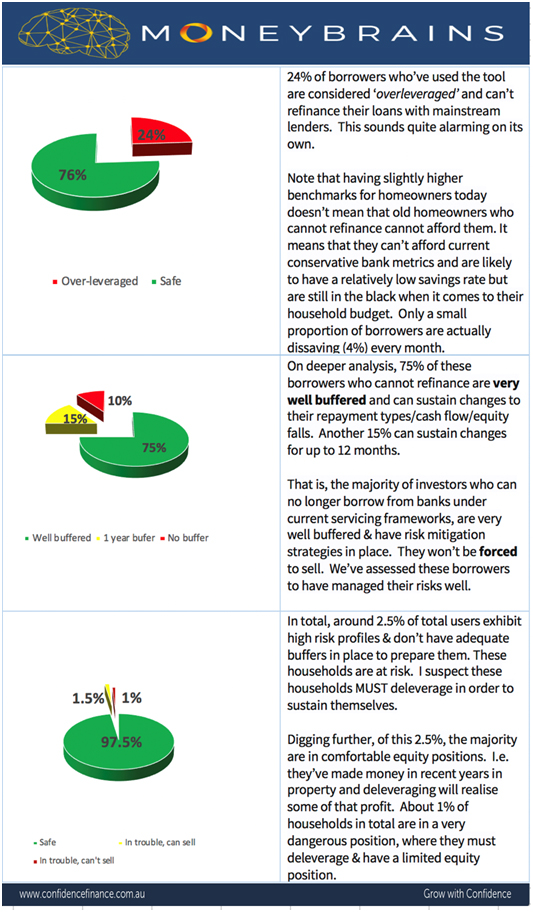

We’ve analysed over 750 users of our MoneyBRAINS software to date which provides data about Australian consumer debt & risk levels. The general story from this data is, is the the household sector will prove resilient to changes in financial circumstances. While debt levels are very high, the banking sector has allocated risk well, with the vast majority of borrowers in healthy financial situations.

MoneyBRAINS data also allows us to rule out to major price crash scenarios:

- IF house price falls causes our banking system to collapse, than Australia indeed may be heading for a world of pain. This is highly unlikely based on APRA stress testing of banks, our low LVR position & the well functioning nature of our financial system.

- IF borrowers cannot afford an increase in repayments & cannot refinance, this may trigger a SUPPLY shock by forced sellers. This again, is highly unlikely. You will see this in pockets of the country (OTP, investor markets). In general, the macroeconomic impact will be minimal.