How to capitalise on a heating market

As Australian consumers continue their sea change shift, investors looking to capitalise are being advised they may have a limited window with a deeper analysis of the area required before purchasing.

In a conversation with Smart Property Investment, InvestorKit’s head of research, Arjun Paliwal, explained the driving forces behind a push towards a sea change.

“The sea change is definitely happening. The rental market is the first to show this because people do not need large liquidity changes,” Mr Paliwal said.

However, investors are being advised that they might not be able to get the bargain they were hoping for when purchasing in a coastal area.

“The clear theme we are seeing is the rental market is displaying a tremendous shift towards houses.

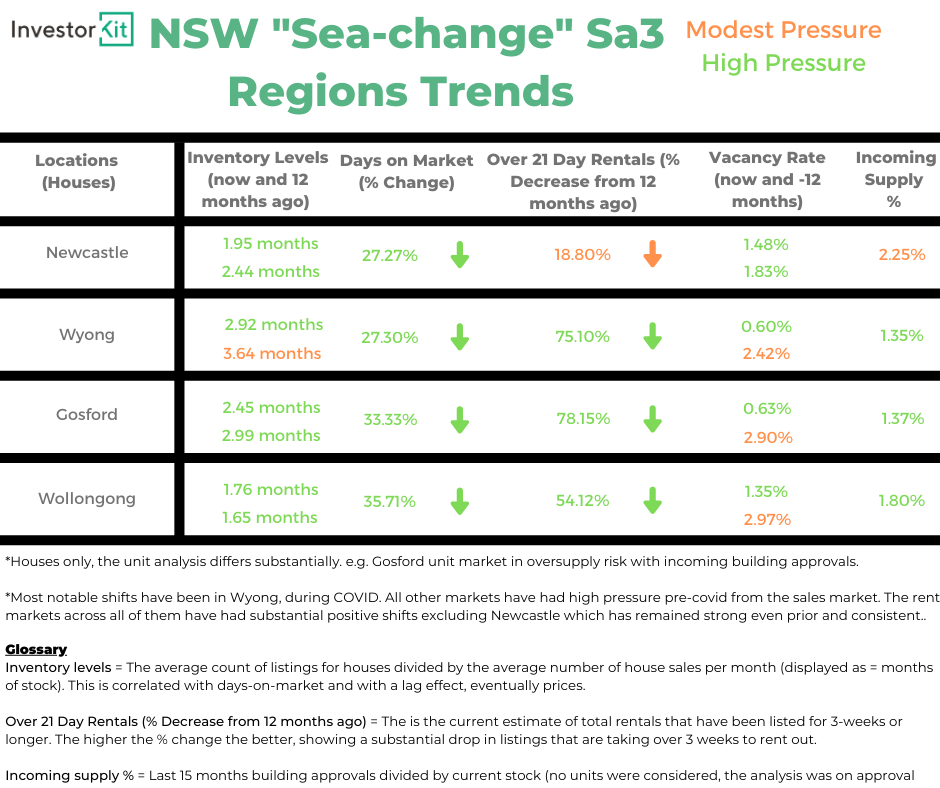

“With regards to stock levels, all four regions display extreme lows in stocks, with high pressure likely.

“From the last census, all of these regions have a high outright ownership, so many people in these regions do not need to sell,” Mr Paliwal told investors.

While pointing out it might be difficult to enter the market, Mr Paliwal explained to purchasers that it is important they look at the property from an investment perspective and do not simply fall in love with a beachside property.

“Investors are going to find it difficult to buy in these four regions in pockets where there is not a large supply of new builds and supply coming towards the middle.

“In areas that are built out, investors will find it difficult to compete with owner-occupiers.

“On the ground, we are seeing many open homes being sold in the first weekend, as well as the first open homes having 30 to 50 people attending, with many owner-occupiers pushing prices to a higher range,” Mr Paliwal said.

Due to such high demand, Mr Paliwal noted that investors looking to get into a sea change market might consider not having a hard number.

“I think, in these areas, you need to have a deeper dive on your comparable analysis than ever before.

“It goes beyond it looks nice or has a nice feeling. Instead, investors need to consider room sizes, dining and lounge room finishes, bathroom situations, backyard situations, car park spacing, neighbourhoods, and is it walking distance to shops.

“In these areas, rather than coming up to a straight price, they need to break down the comparables more than ever before. Only because what might look nicer from a house might not be in the right neighbourhood or have the right bells and whistles,” Mr Paliwal said.

He also pointed out that in markets where they haven’t seen the percentage rise but have seen an increase in interest, those who miss out on the first property will all be competing for the next one.

“If 30 people miss out, they will join you for the next. A sales agent will say a comparable sell in two days at or above the price range.

“They are going to take that comparable to their next vendor listing presentation. This is when the start of market upticks occur and new listings rise in prices.

“This is where people need to be mindful that by setting hard limits and not doing a deep-dive comparable analysis, they might miss out on properties, and when they find the right one, they might pay a little too much,” Mr Paliwal concluded.