Gold Coast hotspots identified in new PRD report

If you’re looking to add a property on the Gold Coast to your portfolio, here are some affordable suburbs and housing hotspots worth considering.

PRD’s latest Affordable Living Property Guide highlighted Sydney as the most affordable city, but there are still plenty of opportunities to be found on the Gold Coast.

The report found that a dominant 34.4 per cent of homes sold in the Gold Coast Metro area over the 12 months ending in March did so for a price of $850,000 or greater.

By comparison, units sold over the same period were split between the $550,000 or greater and $399,999 price brackets at 36.7 per cent and 33.3 per cent, respectively.

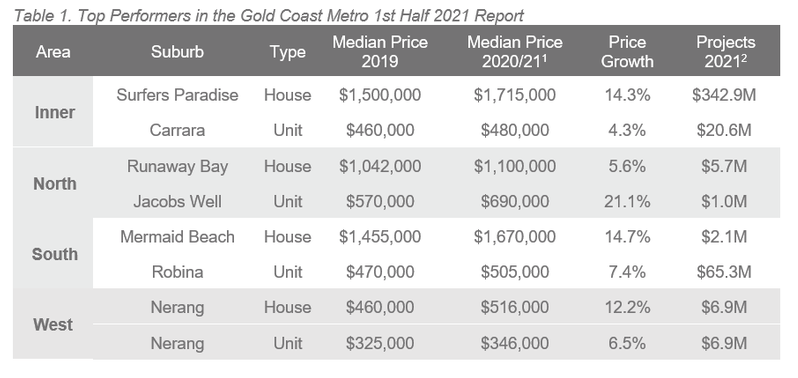

In terms of housing hotspots, Surfers Paradise and Mermaid Beach topped the list with median price growths of 14.3 per cent and 14.7 per cent, respectively. Units in Jacobs Well also fared well, with prices growing 21.1 per cent over the first half of 2021.

While PRD acknowledged these trends do indicate that the Gold Coast Metro is a premium market, they noted a number of opportunities in the region for those seeking something more affordable.

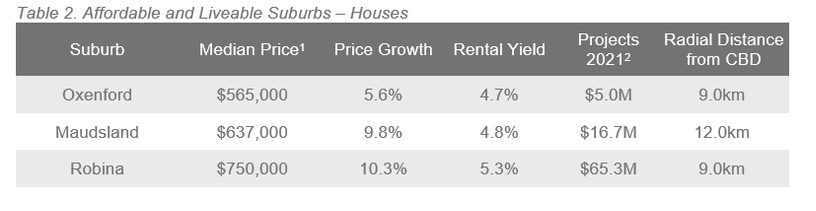

As with PRD’s other reports on affordability, the key detail here is the difference in price between properties located within the Metro area of each city and liveable suburbs within a 20-km radius of the CBD.

PRD identified affordable and liveable suburbs in the region by calculating the premium of living close to the Gold Coast CBD, adding that number to the price of an average Queensland home loan and then cross-referencing it with housing data to identify which suburbs offered a median price below that of the Gold Coast Metro area at large.

Factoring in the above plus the overall level of investment and liveability, PRD’s latest half-yearly report named Oxenford, Maudsland and Robina as the most affordable and liveable suburbs for houses in the Gold Coast Metro.

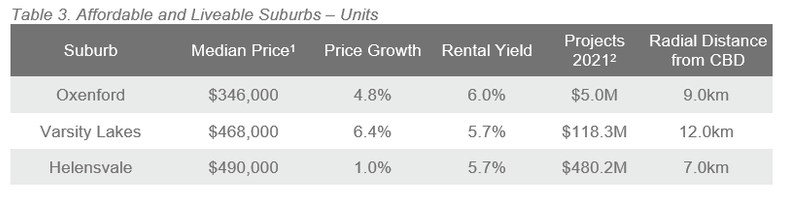

According to PRD, the Gold Coast Metro area is also especially ripe for property investors eyeing an apartment or unit.

As of March, unit rental yields in the Gold Coast Metro area were 5.5 per cent, with the median unit rental price rising 6 per cent while the average number of days on the market declined by 33.3 per cent to 16 days.

“The Gold Coast Metro rental unit market has shown strong growth and resilience throughout COVID-19, which is a comfort to investors who may be wary of a unit rental oversupply due to restrictive economic and border conditions,” the report said.

Factoring in these trends, plus the level of investment and livability, PRD highlighted Oxenford, Varsity Lakes and Helensvale as the key suburbs that buyers should keep an eye out for.

Looking at the market as a whole, PRD found that median property prices in the Gold Coast Metro area increased by 20.2 per cent from Q1 2020 to Q1 2021. The median price for a unit in the region increased by 10.2 per cent to $496,000 over the same period.

According to them, “Gold Coast Metro’s median price growth occurred amid increased sales activity, indicating real returns in capital investment. This is great news for current and future owner-occupiers, as they can be confident of the property’s market value.”