What’s next for the property market? Is it a Rental Boom?

We all know that the property market has cooled off with auction clearance rates down to 50 to 60 per cent for Melbourne and Sydney.You may have seen my recent article where I deep dive into how the property market is behaving and the truth about whether the Property prices are falling by 20%. Click here to read more.

But there are however several pockets in these capital cities that continue to enjoy strong demand and as a result, strong growth.

For example at the time of writing this, Epping in Melbourne has been a star performer achieving a 25.26% growth with the median houses price being $595,000. Killcare Heights in Sydney has enjoyed a 50% growth bringing its median house price to $1,305,000.

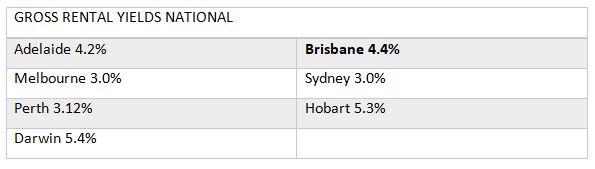

What is really exciting is that vacancy rates are low, making gross rental yields strong for most capital cities – see table below.

Population growth is high, interest rates are still at historical lows and vacancy rates are also very low.

Investors over the last couple of years have been copping a hammering with all the new rules of finance, changes to lending limits and changes to negative gearing.As a result many investors are bracing themselves for a collapsing property market.

If you are one of these investors or are apprehensive about the market in general, I encourage you to click here and read my article where I discuss how you can leverage today’s market as an opportunity for yourself.

And if Labor wins the next election, they are already making noises about removing negative gearing all together. If that happens, our negatively geared properties will become even more negative cash flowed.

Do you remember the last time Labor removed negative gearing? It was a disaster.

Rents skyrocketed to the point where the government reversed their decision two years after they implemented it due to rents being unaffordable.

So, let's talk about this for a moment.

The government provides social housing and if you know anyone who is on a government social housing waiting list, the wait for a house can be up to six years. The government realises that it cannot afford to provide housing to everyone and hence why investors play a major role in providing social housing.

You see, investors (rightly or wrongly), provide social housing. We provide properties for rent and in return receive a tax benefit at tax time to help investors cover the costs associated with owning that investment (if negatively geared). So whether people like it or not, the government is not in a position to provide enough rental properties (or social housing) for people to live in.

So they need investors… but…

If they remove negative gearing or make major changes to the structure of investing in property, this will scare away many of the mums and dads who are just trying to get ahead and have a little extra in retirement.

The truth of the matter is that most investors earn an average income and save their pennies to endeavor to build some wealth for their twilight years.

The government on the other hand is suggesting that only millionaires own property and as a result should pay more tax.

I guess that is a debate for another day, however its important to understand that the government needs investors to help provide social housing and if they tamper with it too much, then we may see a repeat of the 1990’s whereby we will experience another rental boom as mums and dads will pull out of the market or worse still, not consider property as an investment option. Should this happen, there will be a decline in rental properties available and therefore it will become a supply and demand issue.

When there is a shortage of supply and an increase in demand, prices go up.

You may recall not long ago, there was a shortage in the supply of bananas and the price increased to $15 per kilo. For those of you who enjoy eating lamb, it too is in short supply at the moment and as a result, the price per kilo has skyrocketed.

Same with property.

If there are not enough rentals to meet demand, then rents will increase.

This is my predication.

I believe there are going to be a chain of events that will create a supply and demand issue and for those investors holding on to their investment properties, will experience an increase in demand for their properties.

About the Author:

Helen Collier-Kogtevs is the Managing Director of Real Wealth Australia, a leading education and mentoring company for real estate investors. Not only is she a highly successful property investor and an educator, but also a best-selling author, and a philanthropist.

Helen is particularly passionate about helping people, especially people who are keen to create wealth and make a difference in their lives. She has been mentoring thousands of new and experienced investors in their pursuit of wealth creation through property.

She founded Real Wealth Australia to mentor investors create wealth and financial freedom by focusing on helping them build an investment strategy to fit their individual goals, rather than focusing on one particular investing method using her successful property investing system.