What is Rentvesting, and why are many young professionals doing it?

Put down your avocado toast for a minute and let me ask you a few important questions:

- Is it unaffordable to purchase a property in the suburb you want to live in?

- Are you avoiding being ‘tied down’ to your mortgaged home?

- Prefer the freedom of renting?

- Want give your property portfolio the best start from a growth and borrowing capacity perspective?

If you answered “yes” to one or more of these questions, the attractive and popular concept of ‘rentvesting’ might be an option for you.

What is rentvesting?

In simplest terms, rentvesting is the situation where you purchase an investment property that provides you with the potential upside of capital growth and cashflow (more on this below) and rent to live in an area that you want to live in (eg. that trending suburb or street that has comparatively low rent but ridiculously high purchase prices).

Rentvesting gives you the best of both worlds:

- You can live where you want to live, and enjoy the lifestyle you want, AND

- You get on ‘the property ladder’ and start building wealth for the future.

It means that someone else pays for your mortgage (your tenant pays you rent, which you then use to pay the bank)… while you get to live in the area you love.

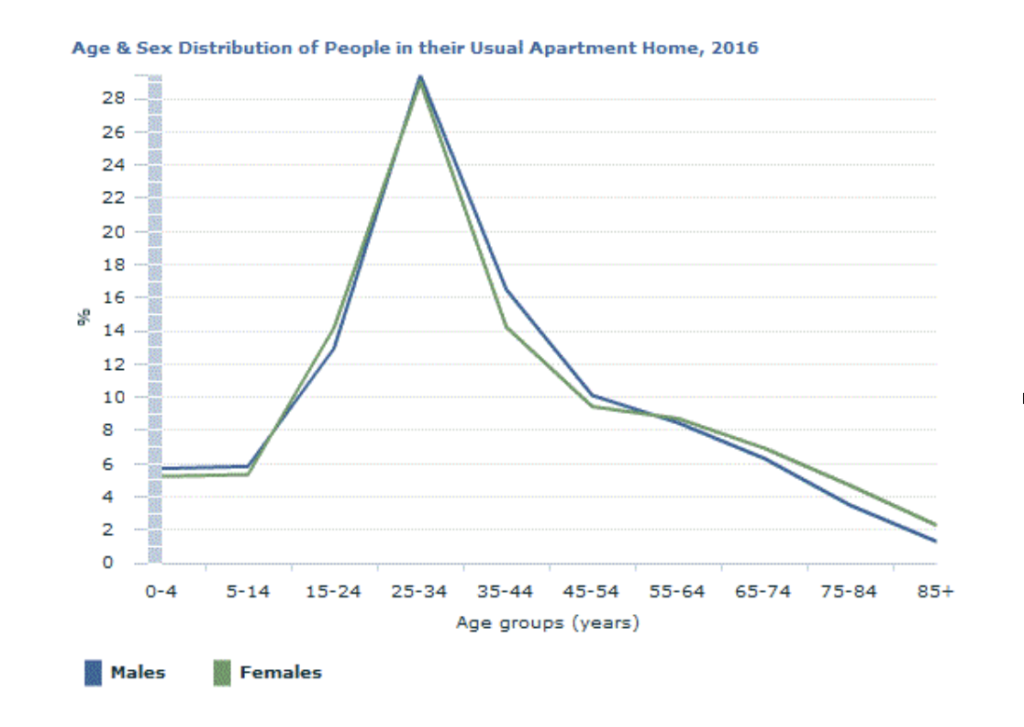

Rentvesting is growing in popularity with young professionals, mostly because city and apartment living matches their lifestyle… but rising property prices keep them locked out of the market in that area.

Plus, an apartment may not be a good asset to include in your portfolio, hence renting an apartment and purchasing another property type is a more strategic option that could provide better (a) lifestyle and (b) investment benefits.

Rentvesting explained in numbers

Let’s look at two scenarios, so I can explain rentvesting in more detail.

Scenario 1 – “Buy Your Own Home”:

- Let’s say you purchase your own home. It’s worth $500,000.

- You borrow 90% (including mortgage insurance), which means you owe $450,000.

- You borrow at an interest rate of 5% (today’s rates are lower, but I’ll be conservative)

- This means you’ll need to pay $870,000 for a $500,000 property.

- Since there was no tenant, you pay ALL of this to the bank (not including outgoings eg. rates).

Scenario 2 – “Rentvesting”:

- Let’s say you purchase an investment property for $500,000.

- You borrow 90% (including mortgage insurance), which means you owe $450,000.

- You borrow at an interest rate of 5% (today’s rates are lower, but I’ll be conservative)

- This means you’ll need to pay $870,000 for a $500,000 property.

- Now, let’s say you get a tenant in, who pays rent at 5% yield (This means they pay you 5% of the value of the property each year in rent) which means an income of $480 per week, or $25,000 per year.

- This equates to $711,360 paid to you by tenants (after property management, not including any rent increases), over the life of the loan (30 year loan).

- This means that all you need to pay is the difference of $158,640 over the life of the loan, instead of $870,000. (not including outgoings eg. rates).

- Of course you still have rent to pay, but you have the freedom to rent wherever you like for the price that suits your budget.

Hopefully you’re starting to see the benefits of rentvesting… let’s look at some more.

What are the benefits?

Here are some more benefits of rentvesting:

- Wealth Creation. Your investment property can be used to build your long-term wealth, via its potential growth and cash flow (paid mostly by somebody else – your tenant!). This wealth can be used for your dream home later in life or for more investments to create a passive income stream.

- Potential Tax Benefits. Many rentvestors are entitled to potential tax benefits, as they are investing in property, and are NOT buying something to live in. Note, this isn’t taxation advice – please speak to your accountant or tax adviser for more information.

- Borderless Investing. Rentvesting allows you to purchase in an area anywhere in Australia (or the world!) without limitations. This means you can be very selective about the particular property you purchase, and can engage in a transaction with no emotional ‘strings’… ultimately resulting in an investment vehicle designed to provide growth and cashflow, instead of ‘emotional benefits’ such as lifestyle and personal style preferences.

- Borrowing Capacity. Depending on the property you purchase, rentvesting may also boost (or simply not decrease) your borrowing capacity, meaning you’re able to purchase another property in future. Those that buy their home first and then invest can have their borrowing capacities tied up in their home which reduces this borrowing capacity, plus the banks may consider their debt at a higher amount than what is actually owed at times due to interest rates being able to change, plus other property outgoings. Please see more information below under the section “When does rentvesting work best?”

- Lifestyle. As previously explained, depending on rent to mortgage/property cost differences, rentvesting allows you to live where you want or stay where you are without the compromise in your lifestyle. It allows you to keep your current lifestyle, whilst also building a property portfolio.

- Flexibility. Rentvesting provides you with the flexibility to upsize, downsize, or switch locations without a mortgage to think about. This helps when things change for the good or worse in your personal circumstances. Even travel or a change of location by preference could be your reason.

What are the negatives?

There are a few negatives to rentvesting:

- Incentives. Due to their nature, you might miss out on first home incentives and potentially some capital gains tax benefits.

- Ownership. Whilst you are living in a rented property, it isn’t totally yours. Painting the walls a different colour might require some pre-approval from your landlord ☺

- Dead Money. When paying rent, you are paying another person’s mortgage. This is a mindset issue you’ll have to deal with.

When does rentvesting work best?

Rentvesting works best when you have an investment property that’s cash flow positive, and has the ability to grow in value over time. Allow me to explain in more detail…

What does ‘cashflow positive’ mean?

The idea is quite simple. All you need to do is secure a property that has a rental income (the weekly payment you get from tenants, also known as ‘yield’) that’s higher than its outgoings (outgoings = the cost to KEEP the property, for example interest only mortgage repayments, insurance, rates etc). This means you’re getting money BACK in your pocket each week you own the property, as when principle is paid (or if you remain on interest only) you are paying yourself.

How do I find a positive cashflow property?

Great question. To learn my best tips for finding a positive cash flow property, request a copy of my free checklist titled “How To Find Investment Properties That Pay You”.

This guide explains eight of my best strategies for finding properties that put money back in your pocket instead of YOU having to pay the bank to keep them.

Here are some of the things you’ll discover inside:

- The simple but powerful principle that explains how a property can actually pay YOU (instead of you having to spend money each week on a mortgage)

- The tip that can give you ‘instant equity’ as soon as you buy a property

- Two types of properties that you may not have considered as investment options

- And more

Ready to get started?

Alternatively, if you are short on time, why not find out more about how we may be able to help you with a Free Consultation during which…

- You’ll discover how much (or should we say, how little) it costs to get started with a good quality income-producing property

- You’ll get an understanding of the major mistakes others make (and how you can easily avoid them)

- You’ll get an up-to-date picture of the property market and where to find the best opportunities right now

- You’ll learn a proven method to accurately value properties, so you never pay too much

- You’ll get important insights about lending and current finance trends in the marketplace

- And you’ll discover an easier way to find positive cashflow properties without having to spend nights and weekends on your computer or driving around the suburbs