7 regions that could cool

Investors are being urged to watch for warning signs, with high inventory levels and a weakness in rental markets a likely sign that the area is cooling.

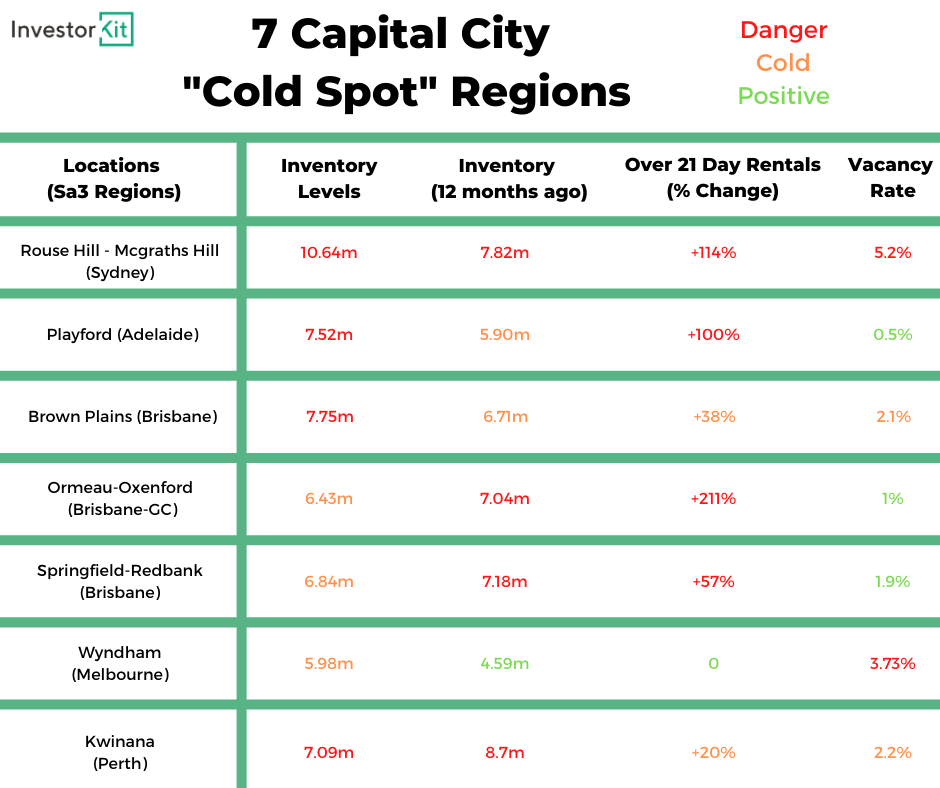

During a conversation with Smart Property Investment, InvestorKit director Arjun Paliwal pointed out seven regions in Australia’s capital cities that are likely to fall.

“What we are seeing here is there are cold regions among hot regions,” Mr Paliwal said.

“Investors just need to be aware that in these areas, there are a high amount of properties available for sales compared with what usually sells, and there is also a high amount of change in vacancy rates or over 21-day listings,” he said.

Mr Paliwal pointed out that the common theme for all these areas is a high supply of new build properties and a higher inventory level.

“Once you look deeper into these regions, are existing built properties still selling fast or are all these new builds making existing properties not sell so fast as buyers have the option of a new or older build.

“When buyers have too many options and properties they can decide on, it’s usually a sign that prices may decline because vendors aren’t in the driving seat,” Mr Paliwal explained.

“Across Australia, inventory levels between 5 and 6 per cent is often the equilibrium, and this is when markets don’t have pressure in positive or negative directions.

“With all these markets sitting above 6, stock is outweighing the monthly sales average by a substantial amount.

“This means it’s unlikely for any substantial price growth in the short to medium term,” Mr Paliwal concluded.

Mr Paliwal has previously discussed the signs investors could look out for when trying to spot a cooling market.