Brisbane property market update December 2023

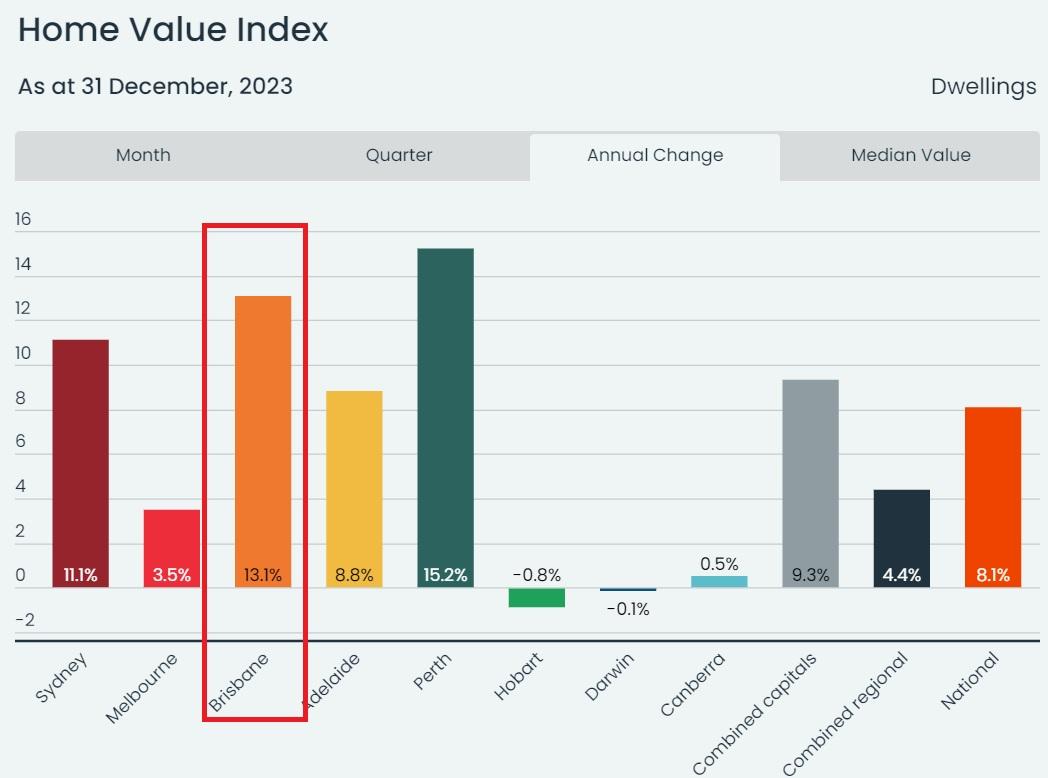

Over the 12 months to December, Brisbane dwelling values increased 13.1 per cent. December’s increase saw 2023 finish with growth moderating month to month, but still well and truly in positive growth territory. Since May 2023, Brisbane dwelling values have been rising by more than 1 per cent every month.

In the report Property Price Declines are Slowing Down in Brisbane, it was shown that there was a shift in on-the-ground buyer activity, which is an indicator of real-time demand that always precedes value changes in the reported data. By March, it was confirmed that the fundamentals were in place for some strong capital growth prospects in the months ahead. What followed was a 12.8 per cent increase in dwelling values over the remaining nine months of 2023. Those who were keeping up with the monthly metrics being reported may have benefited from entering the market around March or April 2023.

At a national level, there was a lot of variation in performance throughout 2023. Brisbane’s growth was second behind Perth which achieved 15.2 per cent growth over the year, whereas Darwin, Canberra and Hobart, the smaller capital city markets, saw property prices remain somewhat unchanged over the 12 months of the year.

This diversity has been attributed to various factors including affordability and supply levels. For example, in Brisbane and Perth, housing affordability has not been as challenging relative to other larger capital city markets such as Sydney and Melbourne. Also, listing volumes have remained stubbornly low in locations where prices have escalated the most, as evidenced by low listing volumes relative to the long-term average. The opposite is true for capital city markets where growth has been lower, or negative. These locations are demonstrating higher than average listing volumes which indicates that buyers have a lot more choice and therefore demand is more diluted.

Brisbane property prices are at a new peak, alongside the Perth and Adelaide markets. Other capital city markets are still below their previous peak, including Sydney (-2.1 per cent), Melbourne (-4.1 per cent), Hobart (-11.2 per cent), Darwin (-7.2 per cent) and Canberra (-6.3 per cent).

New listings in Brisbane in the four weeks ending 3 December 2023 were down -9.8 per cent, according to CoreLogic, and total listings were down -18.3 per cent. Median days on market remained low indicating buyers continued to move quickly when properties became available for sale. Proptrack data also confirmed that the number of enquiries per listing was higher than a year ago in Brisbane, confirming the strong interest in housing across the city.

There are many Brisbane suburbs on the radar of professionals around the country, so it’s no wonder more than 10 per cent of the Hot 100 Suburbs to Watch in 2024 are made up of Greater Brisbane suburbs. Among these, Keperra has been selected for its investment prospects, affordability and infrastructure, Brighton for its location and affordability and Bulimba for its amenity, family appeal and also its location.

Other top 100 suburbs in Brisbane, according to the experts, include Beaudesert, Cleveland, Darra, Morayfield, Petrie, Springfield Lakes, Taringa and Woolloongabba. Brisbane looks set for strong prospects for the future based on property experts from all around Australia. It’s not surprising, given the opportunities that lie ahead for Brisbane in the lead up to the 2032 Olympics.

Apollo auctions data showed that the average number of registered bidders declined throughout December to 3.3 per auction, compared with 3.67 per auction which was recorded in November. This is not uncommon for the three weeks in the lead up to Christmas as many buyers leave the market as they prepare for Christmas and the holiday period.

Clearance rates also dropped slightly, down from 63.25 per cent in November to 57.3 per cent in December. At the same time, the number of active bidders increased from 58.15 per cent in November to 65.4 per cent in December.

Dwelling values in Brisbane

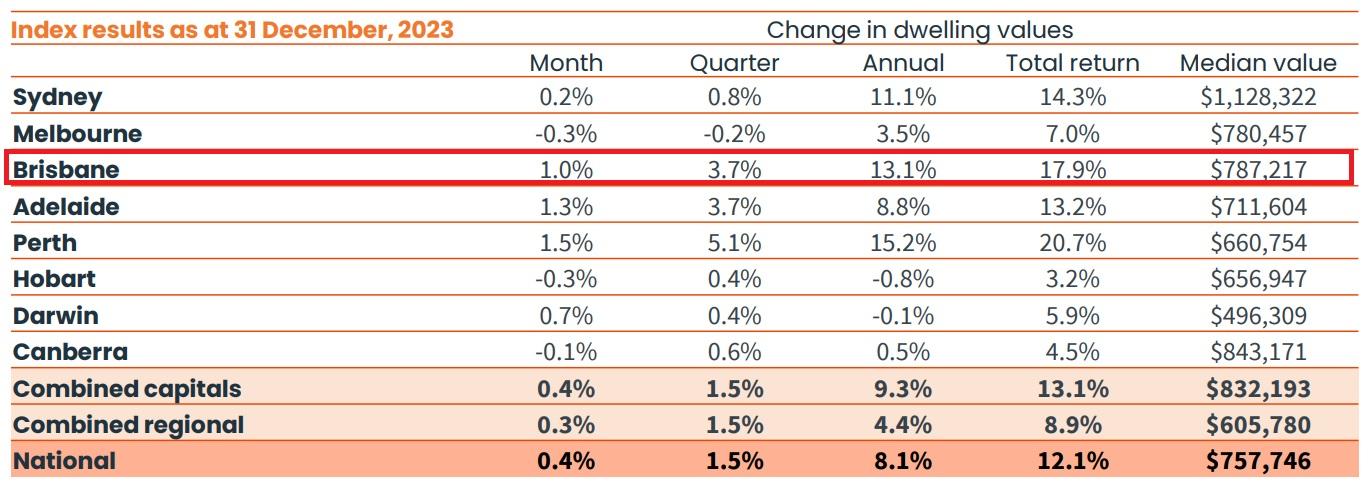

Dwelling values across Brisbane increased 1 per cent throughout December according to CoreLogic, second behind Perth in terms of monthly price growth. On a quarterly basis, Brisbane has experienced 3.7 per cent dwelling price growth. Annual growth is now sitting at 13.1 per cent. The median price for a dwelling in Greater Brisbane is now $787,217, which is $7,947 more than one month ago.

PropTrack data also demonstrated positive dwelling price growth for the month in Brisbane. This data confirms that the monthly and annual growth performance in Brisbane has exceeded the national and capital city averages.

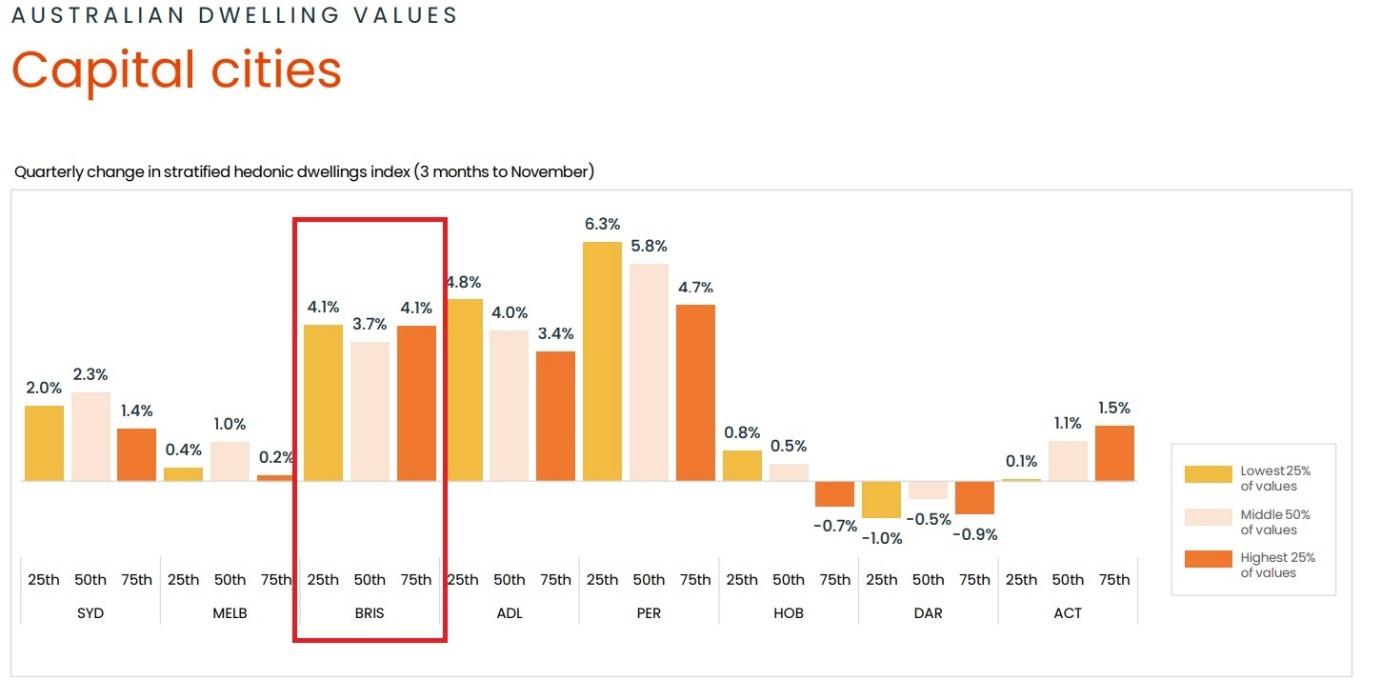

Whereas last month, slightly stronger growth was evident in the lowest 25 per cent of Dwelling Values in Greater Brisbane, with the middle segment and the top 25 per cent of the market not trailing far behind, this trend has shifted once again. The top 25 per cent of property values has risen again to reflect similar growth patterns to the lowest 25 per cent of property values. This is different to most other capital city markets, with the exception of ACT. It does demonstrate the strength in the top end of the market across Brisbane at a time when most other capital city markets have seen a fall off on the growth rates in recent months in the most expensive properties.

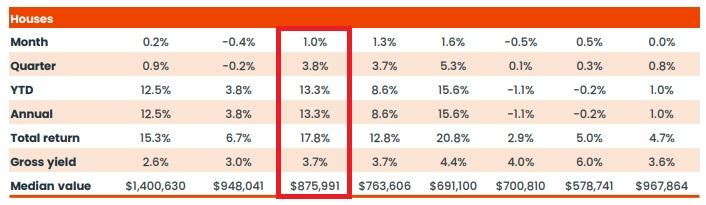

House Price Growth Brisbane

House price growth in Brisbane increased 1 per cent throughout December according to CoreLogic. This is the first month in the last 4 months where we have seen the rate of house price growth slow down slightly in Brisbane. The yearly performance shows 13.3 per cent house price growth in Brisbane putting the current median value at $875,991, which is $5,465 more than last month and $102,821 more than 12 months ago.

PropTrack data confirms the same pattern of positive price growth in Brisbane, showing that annual house price growth in Brisbane is also surpassing both the national and capital city averages.

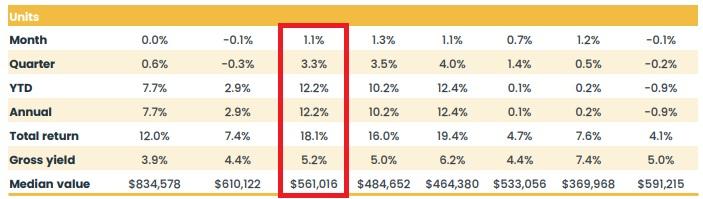

Unit prices in Brisbane

Unit values in Brisbane have surged ahead again throughout December, with a further 1.1 per cent growth during the month recorded by CoreLogic. Wrapping up 2023, it appears that the housing market slightly outperformed with unit market in Brisbane. Annual unit growth recorded a change of 12.2 per cent, according to Corelogic.

The median value of a unit in Greater Brisbane is now $561,016, which is $8,684 more than one month ago and a change of $61,002 over the year.

PropTrack data again confirms that unit price growth in Brisbane has surpassed the average for other capital city markets across Australia, as well as the national average. However, it’s worth noting that the monthly reported change from PropTrack contrasts with that reported by CoreLogic for the second month in row.

Brisbane rental market

Rental vacancy rates across Brisbane eased slightly between October and November according to SQM Research. They moved from 0.9 per cent to 1 per cent, which is a very minor shift – meaning that there are very few rental properties available throughout the city.

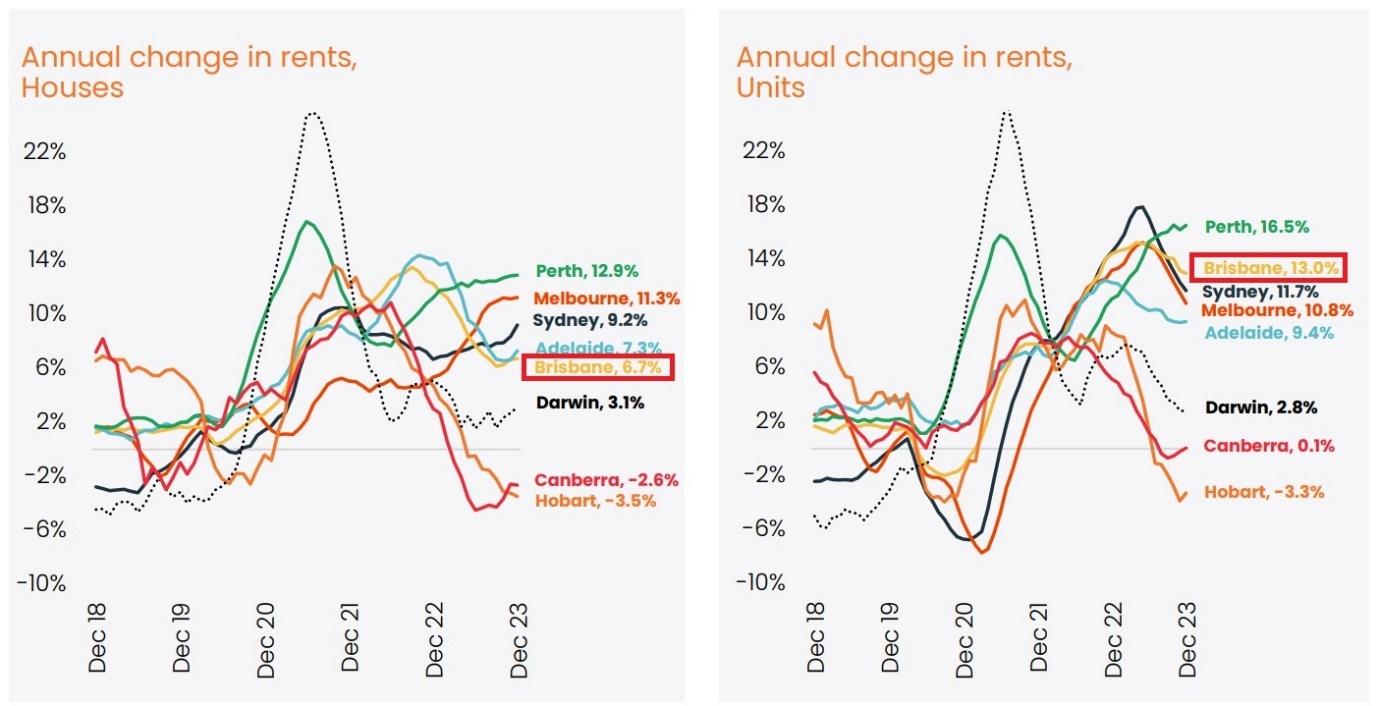

Growth in rents for Brisbane houses shows a growth rate of 6.7 per cent, according to CoreLogic. Gross yields for houses remained unchanged between November and December, sitting at 3.7 per cent for Brisbane.

Unit rents have seen an annual change of 13 per cent across Brisbane. Gross rental yields for units also remained unchanged at 5.2 per cent.

At a national level, house rents increased 7.5 per cent and unit rents increased 10.2 per cent. On this basis, rent price growth in Brisbane across both market segments outperformed the national average over the last 12 months.

With consistently low vacancy rates and little in the pipeline in terms of a material response to rental supply, it is expected that there will still be upward pressure on rents as we move into 2024. Tenants will not find this news particularly favourable. We may start to see some changes in the number of people who form a household as affordability constrains may also start to unfold for some people. These types of structural changes are not uncommon, especially at a time when rental supply is low and demand remains exceptionally high.

Summary

Brisbane saw an easing of growth rates in the latter months of 2023, where the pace of growth pulled back from 1.5 per cent in October to 1 per cent in the final month of the year. Perhaps the rate rise in November sent some unexpected shockwaves through the market as buyers had previously adjusted to several months of rates on hold prior. Despite the higher interest rate environment today, it is now looking increasingly unlikely that we will see further rate hikes in 2024.

Across Australia, there is a trend towards lower inflation, weaker economic conditions and much lower consumer consumption. The labour market is loosening slightly as well, although there remains a very low national unemployment rate compared to historical standards. It looks much more likely that a cut in interest rates by 0.25 basis points may be on the horizon in the first half of 2024, which seems to be the most likely scenario at this point in time.

Also, we are seeing strong wages growth with household wages increasing more than 10 per cent over the last two years. With tax cuts pending for many Australians earning more than $45,000 per annum, we will also see more money flow through to households from July 2024, unless the government scraps this prior.

More locally, jobs growth in Brisbane has been strong up to October 2023. This may contribute to the reignition of demand for property, especially if interest rates also remain steady or in fact start to decline. Confidence always improves when people feel secure in their jobs and when the cost of finance is fixed or declining (meaning interest rates are on hold or declining).

We remain bullish for property prices in Brisbane throughout 2024. Supply remains tight. Listing volumes are still historically low and new supply is constrained due to construction cost pressures and supply constraints.

At the same time demand remains elevated. There are a greater number of people all competing for a smaller volume of properties that are available for sale and this means buyers are outnumbered with every transaction. While these market conditions are in place, prices will continue to increase, although we do expect that this will not be uniform across all of Greater Brisbane.

The future looks bright for Brisbane property in 2024. With many commentators predicting strong price growth for this city in the months ahead, now might just be the perfect time to get into the market before prices continue to escalate.