How Two Investors Increase Their Investment Opportunity By $230,000

Promoted by Mortgage Corp

Case Study: Mortgage Corp helped two self-employed investors successfully secure their 3rd investment property (after their bank refused to lend them any more money).

Self Employed Investors’ 3rd Investment Loan Success

Self Employed Loan Case Study | Mortgage Corp

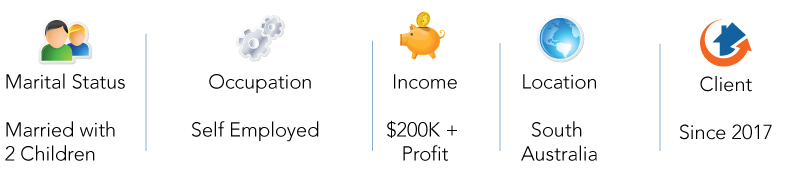

Client at a glance

Executive Summary

Mortgage Corp helped a self employed property investor couple add a third investment property to their property portfolio (total of four houses, including their own home) after their bank refused to lend them any more money.

Loan strategist Neil Carstairs found opportunities to increase their borrowing power by looking closely at their financial statements.

Neil found them a suitable lender and restructuring their loans to allow them to borrow up to $420,000 (after their bank wouldn’t lend them anything!)

Overview

Client: Dan and Rachel, New Client of Mortgage Corp in 2017

Marital status: Married with 2 children

Income: $200,000+ per year company profit

Occupation: Self employed trade services

Location of new investment property: South Australia

Suburbs of existing properties: Coburg, Point Cook and Chelsea, Victoria

Objective: Obtain a loan for a third investment property with solid rental returns to build their wealth

Results: Purchased their third investment property using extra borrowings of $420,000

Background

Dan and Rachel were self-employed investors whose business was going well with a large amount of deposit saved up and good income. They already owned their own home in Coburg, as well as two investment properties in Point Cook and Chelsea. They were keen to continue to invest and buy a third investment property.

However when they went to see their bank, the lending manager told them they had maxed out their borrowing capacity and couldn’t borrow anymore. They read our 5 star customer reviews and decided to ring us to see if we had any other ideas.

The Challenges

- Their bank manager had told them that they couldn’t borrow any more money

- Even though they had equity in their existing properties, lending criteria required them to show they would be able to service the loan through extra income

Objectives

- Find a way to increase their borrowing power to allow them to purchase another investment property

The Solution

We asked Dan and Rachel to have their accountant send us their latest company financial statements so we had a better idea of what they were earning.

What we noticed was that:

- Dan was making extra contributions to super from his company – well above the normal amount of 9.5%. He had been advised to do this to reduce his tax

- Rachel was actually an employee being paid by the company rather than a director – their previous lender had assumed Rachel was a director which meant they couldn’t take into account 100% of her earnings due to director legal liability

- We also saw other non-cash expenses that could be added back to increase their profits for loan assessment purposes, such as depreciation and once off capital purchases

After doing the necessary addbacks to increase their business profits, our knowledge of different lenders’ policies meant we were able to recommend another more favourable lender with a good self employed loan to these investors.

Their previous lender had taken the lowest of their business profits over the last two years as their income for lending purposes. Meanwhile, we knew of a lender that would take into account the average of their profits over the last two years.

Using these techniques and a more appropriate loan structure, we were able to help the couple get pre-approval for another investment loan of up to $420,000.

The final thing we did was help these two investors structure their debt better. Dan and Rachel had a considerable amount of extra cash of $150,000. Instead of putting the $150,000 into the new purchase, we advised them to use it to lower their owner occupier loan. This allowed them to have more tax deductible interest for negative gearing.

It was a good thing that Dan and Rachel came to see us so they didn’t have to miss out on a great investment opportunity – which they would have, if they had listened to their bank manager!

Results

- Bought their 3rd investment property despite being rejected by their own bank previously

- Restructured their loans for better tax savings and further investment opportunities

- Set their long term investment goals and steps to achieve financial freedom

Note: for privacy reasons, names and locations used in this case study are not real client names or locations.

For real Mortgage Corp customer reviews, visit

www.mortgagecorp.com.au/testimonials/ or

https://www.facebook.com/mortgagecorp/reviews/

What’s Next?

Keep reading How To Increase Your Borrowing Power For Self Employed Loans, Case Study- Refinance Home Loan To Pay Off A $40K ATO Debt