CASE STUDY: Investment Success With $0 Deposit $0 Mortgage Insurance

Promoted by Mortgage Cor

Borrowing Power Increased Through A Tax Effective Loan Structure

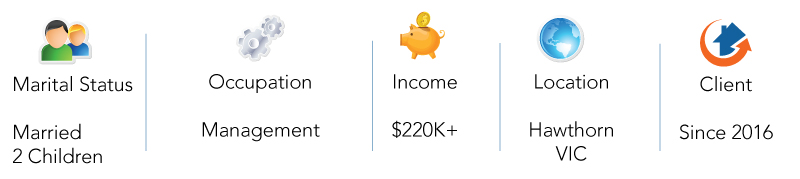

Client at a glance

Executive Summary

Mortgage Corp helped a property buyer purchase an investment property with fantastic development potential. With significantly increased borrowing power and tax effective loan restructuring, this investor was able to secure the investment property whilst avoiding lenders’ mortgage insurance.

- Increased borrowing power significantly by restructuring home and investment loans

- Implemented a tax effective loan structure to help him reach his investment goals

- Bought an investment property with fantastic development potential

Overview

Client: Luke, Client of Mortgage Corp since 2016

Marital status: Married, 2 children

Income: $200,000+

Occupation: Management

Suburb of property: Hawthorn, VIC 3122

Objective: Obtain financing to secure a development opportunity

Results: secured a great investment property without paying lenders’ mortgage insurance

Background

Luke owned a $1 million family home and was interested in growing his property portfolio. He had his eye on a house with fantastic development potential in Hawthorn. He thought he would have no problem getting a loan for the new investment as he’s got a high paying job at a publicly listed company.

He initially asked another mortgage broker to help him find a lender, however neither he nor the other broker realised that lenders were only using 80% of the rental income on his new potential investment when working out his borrowing capacity. After being rejected by a number of banks and not knowing why, he decided to change do some research on mortgage brokers in Melbourne. He read all the good reviews of Mortgage Corp and was compelled to speak to our Loan Strategist Neil Carstairs.

The Challenges

- Luke’s previous mortgage broker was only focussed on getting him the lowest interest rate and hadn’t given due consideration to helping him maximise his borrowing power and achieve his investment goals

- Whilst Luke had a very high income and plenty of equity in his family home, he wasn’t able to demonstrate he could service the new loan as the rental income was not enough to cover his repayments

Objectives

- Find ways to increase his borrowing power, whilst avoiding paying lenders’ mortgage insurance (LMI)

- Restructure his loans so that it was more tax effective and flexible, allowing him to achieve his investment goals

The Solution

We explained to Luke that the reason he wasn’t able to borrow as much as he could was because

- Lenders were only taking 80% of his rental income into account when working out his borrowing capacity.

- His loan structure was also not setup correctly to be tax effective and to provide adequate loan flexibility.

Now that he understood these, he realised he needed other ways to boost his borrowing capacity.

After some further digging, we found out, to avoid paying LMI, he was planning to use cash and savings as a deposit in order to borrow 80% against the investment.

Loans more than 80% of the property price will generally attract LMI (usually a few thousand dollars). However because he only had a small mortgage remaining on his own home, our mortgage strategist Neil Carstairs saw an opportunity to assist Luke to get 100% borrowing on the proposed investment – still without needing to pay LMI.

This not only boosted Luke’s borrowing capacity but also created a more tax effective loan structure. Neil also suggested Luke speak to his accountant to possibly get more out of his loan from a tax perspective in relation to his new investment loan.

Increasing his borrowing power allowed Luke to secure the development opportunity he wanted. Restructuring his loans also created more tax efficiencies and put him in a better position to purchase further investments in the future as part of his investment goals

Results

- Increased borrowing power significantly by restructuring home and investment loans

- Implemented a tax effective loan structure to help him reach his investment goals

- Bought an investment property with fantastic development potential

Note: for privacy reasons, names and locations used in this case study are not real client names or locations.

Mortgage Corp Client Testimonials

For real Mortgage Corp customer reviews, visit

www.mortgagecorp.com.au/testimonials/ or

https://www.facebook.com/mortgagecorp/reviews/

What’s Next?

Keep reading How To Increase Your Borrowing Power For Self Employed Loans, 9 Income Sources That Could Boost Your Borrowing Power.