Making The Best Decision Starts With 100% Of Options

Promoted by Propertyology

Consider this: ‘Investor A’ and ‘Investor B’ both purchased separate properties for $400,000 each. Fast forward to fifteen (15) years’ time and ‘Investor A’s’ property is worth $600,000 while ‘Investor B’s’ property is worth $800,000. Which property will make a greater contribution to the investor’s retirement?

The answer to this question is very logical however, the initial decision making process for a lot of investors is far from logical.

Decision making is a refined skill. Really good decision making starts by first exploring what ALL of your options are. Often, it won’t be obvious to people what all those options are – one can’t know what they don’t know – so seeking the advice of a genuine specialist will expose one to more options. There can be very few more important financial decisions than picking the right property to invest in.

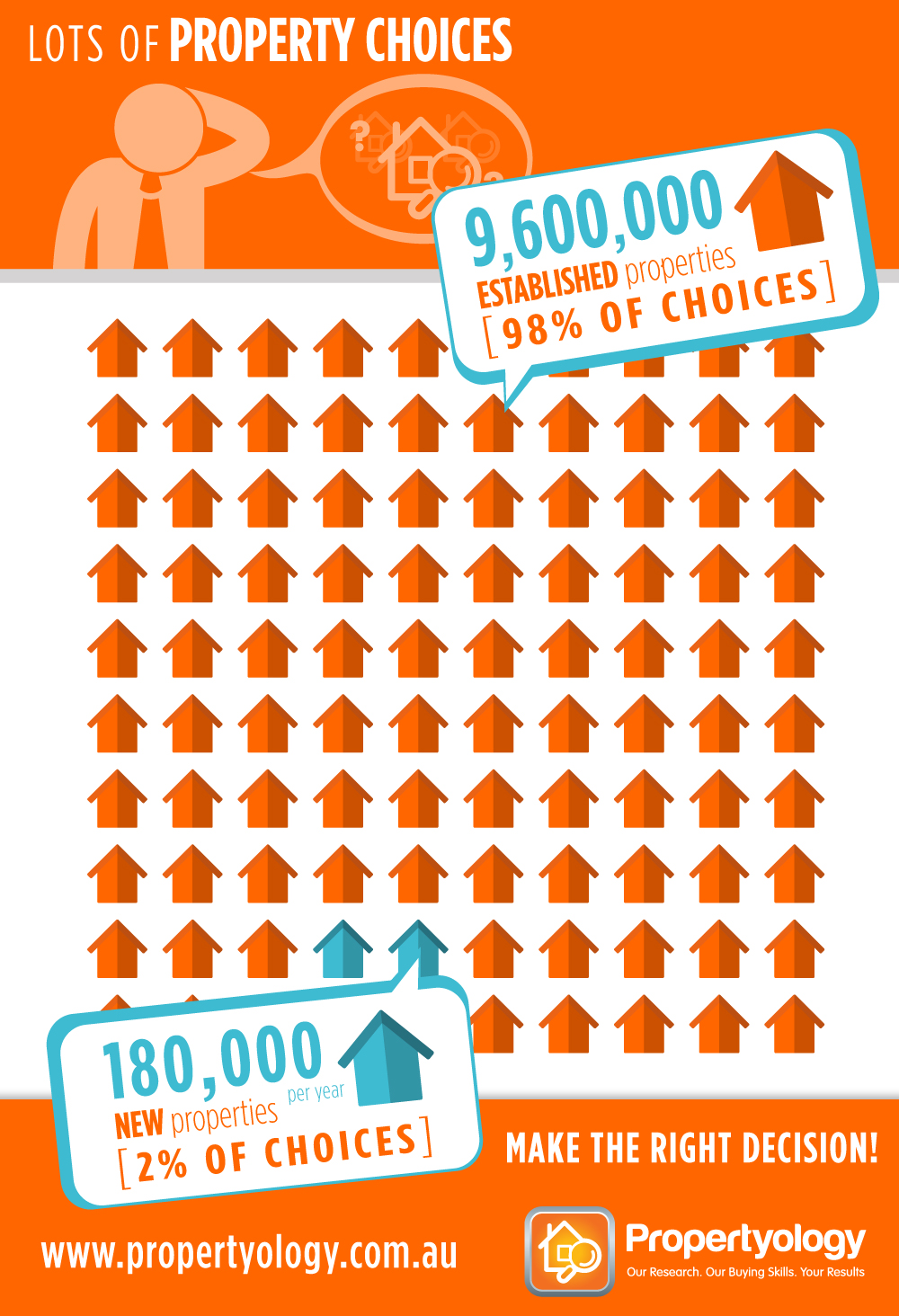

Property investors ought to first start their decision-making process by acknowledging that there are in excess of 9.6 million properties across Australia’s 550 local government jurisdictions. That’s a lot of choices!

Historically speaking, Australia has built on average 160,000 new dwellings each year. Over the last few years, this figure has increased to around 200,000 new dwellings per year. For the purpose of the exercise, let’s say that 180,000 new dwellings are added to the existing pool of 9.6 million dwellings each year.

Now, it is true that there are bigger tax deductions (depreciation benefits) to claim on brand new property. But, depreciation deductions can also be significant on established properties, too. Many of the properties that our buyer’s agent team have purchased for our investors have well in excess of $100,000 in claimable depreciation benefits.

At the end of the day though, taxation benefits should not be any investor’s primary reason for investing. While we all want to take advantage of every benefit available, the primary reason for investing is to accumulate a big enough net asset base so that, in the future, we have sufficient passive income without relying on work.

Common sense suggests that ‘Investor B’ referred to earlier is better placed than ‘Investor A’.

Investors need to avoid being ‘lured’ in to the features-and-benefits that property promoters refer to when trying to sell new property.

The sale price of a brand new property typically includes a 40 per cent loading for taxes associated with the initial construction. When compared to the price of a comparable established property, the owner of a new property is behind the 8-ball from Day 1.

Remember, all brand new properties become subject to wear-and-tear anyway. And, unlike machinery, properties don’t have a ‘used by date’ – as properties change hands they are often renovated. A property within my own portfolio is 106 years old and I have incurred less outgoings for repairs and maintenance than many other properties which are decades newer.

An astute property investment decision starts by reviewing the supply-and-demand investment fundamentals of the markets of Australia’s 550 local government jurisdictions – 100 per cent of your options – not by limiting your potential to 2 per cent of your choices (new properties).

Simon Pressley is Managing Director of Propertyology, a REIA Hall Of Fame Inductee, property market analyst, accredited property investment adviser, and Buyer’s Agent. Propertyology works exclusively with property investors to purchase properties in strategically chosen locations all over Australia.