The Next Step for Sydney and Melbourne Investors

Promoted by Propertyology

There’s no question Sydney and Melbourne property owners have been riding the golden wave of property price glory for quite some time now. And we all know that good things eventually come to an end.

There’s been plenty of speculation and debate about peaks and bubbles but, with burgeoning populations, let’s be honest, prices are unlikely to slide that dramatically in Australia’s two largest cities. It’s generally accepted though, that the booms in both cities are over.

So, where to now for keen investors willing to capitalise on their equity?

Get out of town. No, really, get out of town!

Simon Pressley from market research and buyers’ agency firm, Propertyology, has looked closely at a range of locations across the country and come up with a few clear favourites for future capital growth.

“The greatest danger in the cooling of Sydney and Melbourne markets, is that investors assume that our whole nation is off the boil. You couldn’t be more wrong. Outside of Sydney and Melbourne, most of Australia has experienced very little price movement since the onset of the GFC. Their growth cycles lie ahead of us,” Pressley says.

Hundreds of thousands of Sydney and Melbourne property owners now have some good equity but the important thing is to put that to good use. Failing to do that is akin to a farmer with pocket full of seeds – we can’t begin to grow our orchard until we put the seeds in the ground.

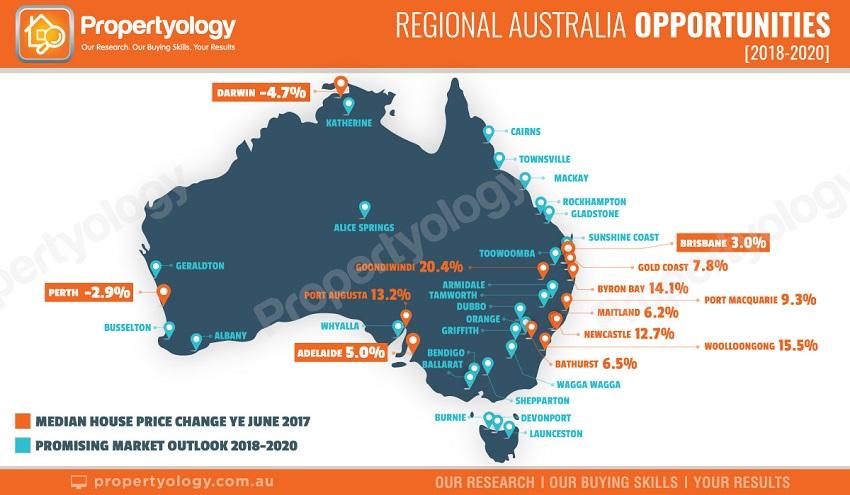

According to Pressley, investors will need to remove the blinkers to discover the most fertile soil to grow that orchard. And, he says this includes having an open mind to parts of regional Australia.

But who’s got the time and the expertiseto know where to get top quality information to work out exactly which part of (affordable) regional Australia might be the best option?

That’s where a full-time property market research firm comes in remarkably handy.

Propertyology is one of Australia’s most respected property market analysts. They’ve studied Australian property market history to determine the biggest influences on market performance. Research is not a hobby, it’s a profession. Propertyology spends every day analysing markets all over Australia - capital cities and regions. They know how to identify growth drivers, economic trends, housing supply pipelines, infrastructure projects and more.

And, the cherry on top is that their research team work closely alongside their multi-award-winning buyer’s agency team to identify the right location, to find that right property, and to negotiate the lowest price for you.

Propertyology were the only research analysts in Australia to predict that Hobart would have a stellar 2017 and outperform every other capital city. Pressley says that their research methodology uncovered Hobart’s growth potential back in 2014 when the market was flat and the economy had been weak for several years.

“We backed our professional judgement and our buyer’s agents helped dozens of people from all over Australia to invest in Hobart between 2014 and 2016. Those same happy clients have now experienced comparable capital growth rates to Sydney and Melbourne and higher rental returns.”

And, while the Hobart market looks likely to continue to go gangbusters for some time yet, Pressley says that Propertyology’s attention has now turned towards several regional locations across Australia that have a very exciting outlook.

Housing demand can be driven by a variety of forces. From new job-creating infrastructure projects, to improving economic conditions, relocating baby boomers, government policies to decentralise population, sea-change and tree-change lifestyle choices, and migration towards more affordable locations.

“Booms like Sydney and Melbourne generally only come around every 10 to 15 years, so it’s now more important than ever to get the accumulated equity from the last few years working for you.Using that equity to invest elsewhere means taking advantage of new opportunities while also adding diversification to your property portfolio.”

It’s common sense; any experienced investor will tell you that diversifying is always a good idea.

“Savvy share market investors never put all their eggs into one basket. They put their money into a range of stocks across multiple industry sectors. Property investment is like being shares in a community. Propertyology’s philosophy is to accumulate a diversified property portfolio by using bite-size pieces of equity (or cash savings) to purchase in multiple states, cities and regions.”

Propertyology believes that many of the lower profile cities have a better outlook for the next three years, than the last three years. Using the same research methods today that they used to identify Hobart back in 2014, they claim to have uncovered a few new gems in parts of regional Australia.

“We place heavy emphasis on understanding the industry sector mix of local economies all over Australia. We draw information from lots of sources and join the dots in relation to future demand and supply. Our objective then is to help our clients buy property in these locations before the market starts to heat up, enabling them to benefit from 100 per cent of the pending growth cycle,” Pressley said.

The good news is the cost to get in and the cost to hold are both much lower in the regions. You can buy a brilliant investment property in the range of $300,000 to $450,000, with better growth potential and higher rental yields than something twice the price in a capital city.

So, go west, or north, or south, or east – all depending, of course, on your starting ‘Location, Location, Location’.

“If you’ve got property equity in Sydney or Melbourne, you quite simply need to broaden your horizons. Look seriously at investing in other locations – it’s really a case of diversify, or die wondering!” he says.

Propertyology is a national property market researcher and buyer’s agency who buys properties exclusively for investors in strategically-chosen locations all over Australia. The multi-award-winning firm’s success includes being a finalist in the 2017 Telstra Business Awards and 2016 winner of Small Residential Agency of the Year in REIQ Awards For Excellence. Managing Director Simon Pressley is a REIA Hall Of Fame Inductee and a three-time winner of the REIA and REIQ Buyers Agent of the Year award.