9 Financial Terms Every Home Buyer Must Know

Promoted by HashChing.

Before you even start looking for a home, brush up your financial knowledge with these important home loan terms that will help you understand your mortgage better.

Planning to buy your first home? But how much do you know about real estate?

Take this simple test to find out.

- What does lenders’ mortgage insurance cover?

- Is there a cooling off period when buying at auction?

- When do you pay the deposit if you’re buying at auction?

- What is an offset account?

- What is conveyancing?

Befuddled? You’re not alone!

According to home finance lender, ME Bank, 61 per cent first home buyers (FHBs) failed the basic property test outlined above.

Sharing the results of its survey, the bank revealed that 88 per cent FHBs don’t understand that lenders’ mortgage insurance covers the lender and not the borrower, 85 per cent are not aware that there’s no cooling-off period at an auction, and 78 per cent don’t know that the deposit is due on the day of the auction. Besides, a significant percentage of FHBs don’t understand what conveyancing or an offset account is!

The 2018 HILDA Survey released by the University of Melbourne also indicates low levels of financial literacy amongst Australians. Those struggling the most with ordinary financial concepts include Australians aged between 15-24 and over 65 years of age, singles, unemployed, and those without a high education.

Take informed decisions by brushing up your knowledge

Financial literacy is vital to your economic well-being. The above mentioned HILDA survey reveals that Australians with low levels of financial literacy are less likely to make regular contributions to a savings account, have an emergency fund, or pay off their credit card balance on time.

It is, therefore, recommended to brush up your knowledge about the property buying process before venturing to buy one. You can find a lot of relevant material on the Government’s Money Smart website and also subscribe to blogs and newsletters that will keep you abreast of the market.

For a jumpstart, here’s a list of nine financial terms you must know:

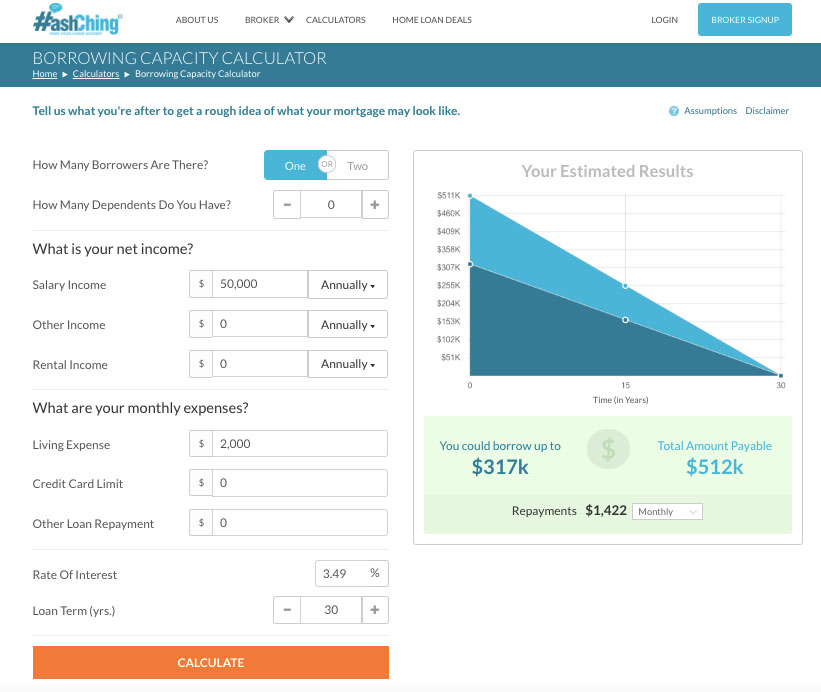

Borrowing Capacity: Your borrowing capacity refers to the maximum amount you can borrow from a lender to purchase a property. Different banks use different criteria for assessing your borrowing capacity. These include your current income, assets and debts, credit card limits, living expenses, etc.

Use this online calculator to find out how much money you can borrow for your dream home.

Compound Interest: Compound interest refers to the addition of interest to the principal amount so that the interest in the next period is earned on the principal plus previously accumulated interest.

For example, consider that you invest $100 at the rate of 10% per annum for 5 years. If you were to earn simple interest, you would only receive $50 on the principal of $100 over the full term. However, if interest were compounded annually, you would have a total of $110 at the end of the first year, $121 at the end of the second year, and so on. Thus, the total amount at the end of 5 years would be $161.05 as compared to $150 in the case of simple interest.

Conveyancing: Conveyancing is the legal process involved in transferring a property from one person to another.

A conveyancer is a legal professional who carries out title searches, advises on sale contracts, and enables buyers to complete the legal obligations involved in the process.

Cooling-off period: When you decide to purchase a home, there is a fixed period in which you can cancel the transaction after the purchase, known as the cooling-off period. However, there is no cooling-off period when you buy a property at an auction.

Disposable income: Your disposable income is the amount of money that you have available for spending after taxes and essential household bills have been accounted for.

Lender’s Mortgage Insurance (LMI): LMI protects your lender in case you default on your home loan. Generally, you will be required to pay LMI if you are borrowing more than 80 per cent of a property’s price.

Depending on the size of your mortgage, LMI can run into thousands of dollars. However, it is possible to roll over your LMI premium into your home loan amount.

Note that LMI only protects the lender and provides no protection to the borrower.

Mortgage Protection Insurance: It is a type of insurance that covers the cost of your mortgage repayments in the event of an accident or sickness that renders you unable to work. This type of coverage protects the borrower and not the lender.

Offset Account: An offset account is like a savings account linked to your home loan, but you don’t earn any interest on the balance. However, the money in your account is offset against your outstanding home loan so that you are only charged interest on the difference between the two.

Many lenders offer a free offset account facility to borrowers, which can help you save a lot of money on your mortgage. Read this article on .

The Bottomline

Understanding your home loan will enable you to make sound financial decisions and navigate the real estate market with confidence. However, if you feel confused, don’t be shy of seeking professional help from a mortgage broker. Your broker will not only negotiate your home loan on your behalf but also suggest options tailored to your financial condition, helping you get the max out of your mortgage.

HashChing, Australia’s first borrower-friendly online mortgage marketplace, is powered by a growing network of Australia’s best brokers. Each broker on the network is verified and must maintain a high user rating to continue receiving leads on the platform.

Start your home loan journey by comparing broker pre-negotiated home loan deals or post your query online to receive a resolution from our expert mortgage brokers, absolutely free. Don’t worry; your data is safe with us. You will not receive any unwanted calls or emails.