Your 90-Day Property Purchase Plan

Promoted by Real Wealth Australia.

When you take action towards creating the financial future you want for yourself and your family, you need to start with a vision of what you want in the next five years, 10 years, or even 15 years.

Many feel that investing in property is difficult or time consuming but when you take it a step at a time, you’ll be amazed at what you can achieve.

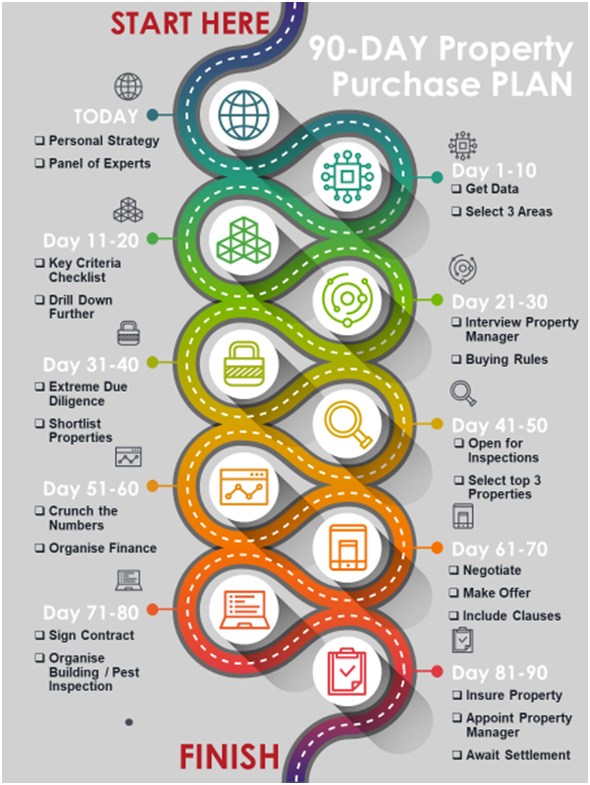

In order to secure your first or next investment property, you need to follow a number of key steps and when you take the necessary action, many of our students end up with a property at the end of 90 days.

Here are the steps you need to follow:

Create your personal strategy – this is your road map and it includes elements like what your budget is, what can you afford to buy, how much is your borrowing potential. This road map gives you a set of buying rules so that when you are looking for the perfect investment, your strategy helps you to stay focused on what you need and not follow the herd.

Your panel of experts – who do you need on your team? Well, to start with you’ll need your finance coach to organise your finance and accountant to help you understand how much you can borrow and what structure to buy the property in. Once you are ready to sign a contract for a property, you’ll then need a solicitor to do the conveyancing, property manager to find you the right tenant, insurance broker to mitigate your risk, pest and building inspector to double-check the property and quantity surveyor to provide a depreciation schedule.Most important is your mentor, to help you every step of the way and make sure you buy the right property for your personal situation.

Data and research –is when you start to gather data and information to help you narrow down all the suburbs to just one. But first, I always ask my students to narrow it down to three suburbs and then conduct deeper research to select the best one.

There are a number of reputable companies that provide data reports for you to purchase. Make sure you look at the past 10 years of capital growth as well as the yield. If possible, look at predictive models to help you understand what the area is likely to achieve in the future. Your ‘on the ground’ research will also validate if the data is accurate and if the suburb is likely to continue growing in value. I give my students a key criteria checklist to shortcut this process as I understand its easy to spend hours and hours researching on google.

The purpose is to continue drilling down on the data until you have a suburb that suits your strategy and a list of potential properties that tick all the boxes. Make sure the short list of properties are the types of properties that tenants want to live in.

The best person to help you nail that is your property manager. I personally like to interview at least 4-5 property managers to give me an idea of what tenants want, that way, I can ensure that tenants will want to rent the property for 365 days of the year.

When you stick to your buying rules and conduct your extreme due diligence, it becomes really easy to shortlist the properties to purchase. This way you also minimise the risk of things going wrong.

I recommend (where applicable) to inspect the property. If you can’t, then make sure you have the property manager, pest and building inspector and real estate agent send you photos, video footage and feedback on the property.

Crunch your numbers – once you have shortlisted to 3 properties, you have attended the open for inspections, then you want to start the negotiation process. Make offers on all properties but remember to ask for discounts. Every dollar you save in the negotiations, is a dollar you have in your back pocket. Make sure that you crunch your numbers, so you know beforehand what your top limit is. If bidding at an auction, stay within your budget.

Once you have got the best price, the proceed with taking it to contract but make sure you include exit clauses to protect you.

Insure your property – many people don’t realise that once you have a signed agreement, you must obtain insurance for the property because if anything happens between after signing the contract and before settlement, you as the new owner, are responsible.

While you are waiting to settle, appoint a property manager to find you a tenant so that they move in straight after settlement. Remember for every week that passes, that is a week of mortgage you need to find.

Finally, remember to celebrate your new achievement! ?

That’s one property under your belt… but how many do you actually need to retire on?

It’s not as many as you think.

How many properties do you need to retire?

In the current market conditions, I no longer believe you need to buy 10 properties in 10 years in order to retire. Instead, I think you can replace your income and retire with just four or five properties – here’s how: Download the report “How Many Properties do Your Need to Retire”

From education to mentoring, beginner investors to seasoned property moguls, we love to share our knowledge. So, if you are stuck and want the support of an expert mentoring team to support you with your investing, click here and let us support you with the answers you are looking for.

About the Author:

Helen Collier-Kogtevs is the Founder and Managing Director of Real Wealth Australia, a leading education and mentoring company for real estate investors. Not only is she a highly successful property investor and an educator, but also a best-selling author, and a philanthropist.

Helen is particularly passionate about helping people, especially people who are keen to create wealth and make a difference in their lives. She has been mentoring thousands of new and experienced investors in their pursuit of wealth creation through property.

She founded Real Wealth Australia to mentor investors create wealth and financial freedom by focusing on helping them build an investment strategy to fit their individual goals, rather than focusing on one particular investing method using her successful property investing system.