Is this the right time to fix your home loan?

Promoted by HashChing.

Is it the time to fix your home loan to beat any potential rate hikes? Or, should you ride the market longer to benefit from the presently available low interest rates?

According to data, fixed rate home loans accounted for 18.67 per cent of the total loans written in June 2018, slightly more than the 17.93 per cent fixed rate home loans recorded in May 2018.

Indeed, there seems to be a resurgence in the popularity of fixed rate mortgages.

But why?

Typically, most homebuyers in Australia choose a variable rate on their home loan that changes according to the market interest rates. This means your repayment amount is not constant and will vary as the market rate changes.

However, with increasing speculation about the interest rates going north, many borrowers are scurrying to fix their home loan rate despite the official rates not having moved for over two years.

So, is it time to fix your home loan?

Well, most experts don’t expect the official rates to rise for at least the next 12 months. However, out of turn rate hikes by lenders cannot be ruled out. Most recently, Westpac, one of the big four lenders in Australia, hiked its owner occupier variable rate by 0.14 per cent per annum. The lender attributed the hike to an increase in its wholesale funding costs. Other major banks are expected to follow suit.

Consequently, many Australian home borrowers who had turned complacent due to the historically low cash rates maintained by the RBA will be pushed to fix their home loans to cushion themselves from the financial impact of future rate hikes.

But, is fixing the rate on your mortgage the key to saving money in the future?

Well, the answer is both yes and no, depending on your financial situation and how you set up your home loan. Though, what is clear is that your mortgage is going to get expensive in the future and if you wish to fix your home loan, this might be the sweet spot when you can lock in a great rate before interest rates move upwards.

The reason is simple – fixed rates are known to increase whenever there is speculation of a variable rate hike. In 2018 itself, there have been significantly more hikes than cuts on owner-occupied mortgages across all fixed terms.

Currently, you can find fixed rate home loans starting as low as 3.58 per cent per annum with a comparison rate* of 4.71 per cent per annum. This is a good rate to lock in if you are looking for the certainty of fixed repayments to tide over any potential rate hikes in the future. But, before you hurry to fix your home loan, here’s some advice from the experts:

- When you fix the rate on your home loan, you continue to pay the same rate of interest for a pre-defined period despite any changes in the market rate. It is, however, advisable to fix your rate only for a short period of up to three years at a time, as interest rate movements are cyclic and you might find yourself paying extra after a few years if the variable rates decline again. Besides, prepaying a fixed rate mortgage is often expensive, which means refinancing to a lower rate in the future could cost you a pretty penny!

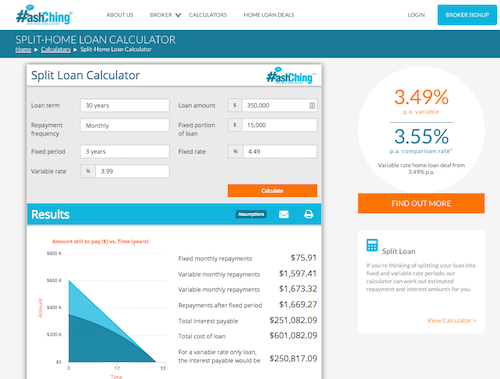

- Lack of flexibility is a major drawback in many fixed rate home loans. Therefore, it could be beneficial to partially fix your home loan to enjoy the benefit of fixed repayments as well as the flexibility of a variable rate home loan at the same time on your mortgage.

Splitting your mortgage can also help you repay your debt faster as you can make additional repayments on the variable part of the loan or maximise your savings with an offset account.

Are you paying too much on your home loan?

Don’t let your bank penalise you for being loyal! Today, the mortgage market is highly competitive. And, despite some lenders increasing the rates for existing borrowers, many banks and non-bank lenders are offering interest rates as low as 3.71 per cent per annum with a comparison rate of 3.72 per cent per annum to new borrowers to boost their profit margins.

Have you revisited your home loan recently? Are you aware how your interest rate stacks up against the current market average?

If you think you are paying more than you should, refinancing your home loan with another lender could potentially save you thousands of bucks over the remaining term of your mortgage. However, don’t forget to calculate your breakeven point before refinancing your home loan to ensure a profitable deal. A mortgage broker could help you crunch the numbers.

Whether you are looking for fresh or refinancing home loan deals, at HashChing, we offer you broker pre-negotiated home loan deals from over 80 lenders that could be as much as one per cent lower than lender advertised deals published elsewhere. Compare home loans online or get in touch with a mortgage broker to understand your options better.

About HashChing

HashChing is Australia’s first borrower-friendly online mortgage marketplace that brings homebuyers closer to their dream of owning a home through more choice and savings. Users can post their home loan queries online and have them answered by verified mortgage brokers on the platform, free of cost.

*All comparison rates are based on $150,000 home loan for a term of 25 years.This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.