3 Powerful Tips to Pay Down Your Mortgage Faster

Promoted by HashChing.

Buying a home is not the same as ‘owning’ one! Yes, until you have paid off the last cent on your mortgage, you home, technically, is not yours.

Do you want to wait another couple of decades to own your home, or, would you rather pay down your mortgage faster and be debt-free sooner? If being financially free is on the top of your list of priorities, here are some simple hacks to get you started:

Play with your repayment amount:

Pay your first instalment before it falls due - Get a head start on your mortgage by making the first repayment on the day of settlement itself! Your first repayment falls due after a month of settling your mortgage. By prepaying it on the day settlement, the entire repayment amount is be applied towards the principal, bringing down the amount of interest on all your future repayments.

Round up your monthly repayment amount - This is a simple hack to pay down your loan sooner. Simply round up your repayment amount to the nearest hundred dollars to pay a little extra each month without feeling the burden on your pocket.

For example, if your monthly repayment amount is $1,450, consider rounding it up to $1,500 to pay down your mortgage faster without even realising it!

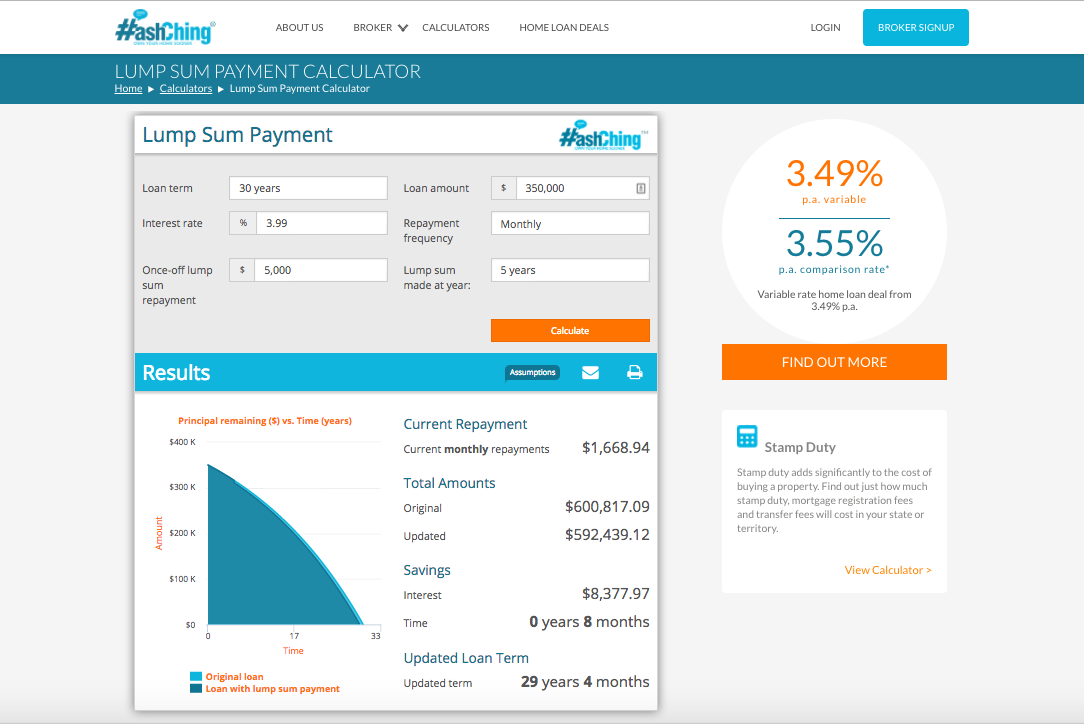

Make lump sum payments - It is also a good idea to apply any windfall gains such your tax refund, bonus money, or gift money towards your mortgage to chip off the principal gradually. Any additional money thrown at your mortgage can make a huge difference to your savings over time. Use this lump sum payments calculator to work out your savings.

Pay more frequently – Instead of making your repayments monthly, consider switching to fortnightly payments to make one extra monthly repayment effortlessly at the end of the year. Why? Because there are 12 months in a year and 26 fortnights!

Keep your repayment amount constant - When you choose to make the minimum monthly repayment on a variable rate home loan, your repayment amount reduces whenever the interest rate goes down. However, by paying a fixed amount each month, despite lower rates, you can build up a buffer that will reduce your principal, and also the interest payable. Of course, you could always redraw the extra money you have pumped into your mortgage in the case of an emergency.

Use an offset account

If you have an offset account linked to your mortgage, use it wisely to pay down your mortgage sooner.

Take a small example. Imagine you have a $300,000 mortgage for 30 years at 4.00 percent per annum. Now, if you keep $30,000 in your offset account, you’d only pay interest on $270,000.

But how does that help, you might wonder?

Well, when you pay interest on $270,000, your monthly repayment reduces by $143 over the first month. In the next month, you’d have $30,143 in your offset account and you’d pay interest on $269,857, and so on…

Of course, you could choose to park your $30,000 in a savings account instead of an offset account, but you’d only earn three per cent interest or lesser and also pay tax on your earnings.

We suggest that you keep your offset balance high by putting every spare dollar into it. You can have your salary paid into your offset account to keep the balance as high as possible.

Offset accounts are generally available with variable rate loans but some lenders may allow the facility with partially fixed loans. Speak to a mortgage broker to know more.

Refinance to a lower rate

Presently, many banks are offering their best deals to new customers while hiking the rates for loyal customers in certain cases. If you already have a mortgage, it is highly recommended to review your rate every six months or so, and demand a lower rate from your bank, if you find yourself paying above the market average of [3.70] per cent pa, much lesser than the golden standard of 4.00 per cent pa a few years ago.

“You should know what your current rate is, and regularly research online for better rates,” says Mr Shah who’s saving $200 a month by refinancing his home loan to a lower rate. “Speak to your bank or lender, and if you can’t get a better deal from them, then be ready to move to a different provider,” he adds.

Compare home loan rates to see how your rate stacks up against the market average. If you think you are paying too much, call up your lender and ask for a better rate. Once your bank knows you mean business and won’t hesitate to switch lenders for a better deal, it is likely you’d be offered a reduced rate if you have been a loyal customer with a good repayment history.

If, following a call to your lender, you are not satisfied with the reduced rate, get in touch with a mortgage broker and let them negotiate on your behalf to find you the best possible deal on your home loan.

Be debt-free sooner!

According to psychologists, people who find it difficult to pay off their debts are more likely to suffer from depression, stress, and anxiety. Therefore, it is only beneficial that you pay off as much of your debt as possible when the interest rates are still low to avoid mortgage stress in the future.

Following these simple hacks can help you pay down your mortgage faster and live debt-free in your golden years. In case you are not sure of the exact features you need in your home loan, just tell your mortgage broker what you want out of your mortgage so that he or she can guide you to the best-fit product for your requirement. Speak to a mortgage expert.

HashChing is Australia’s first online mortgage marketplace that allows users to compare broker pre-negotiated rates from 70+ lenders across Australia. Users can also post their home loan queries online to have them resolved by experts in a transparent manner, free of cost.