From corporate to mortgage broking: How this property investor pursued his passion

As he went on to build his 14-property portfolio, Michael Xia also found a way to help his fellow investors quit the rat race and afford financial freedom for themselves by being a dedicated mortgage broker.

The property investor has always been fond of sharing his journey to other people—from a decade spent in a corporate job he hated to finally transitioning to become a successful property investor—and for him, his mission as property professional is to make better and more sophisticated investors who can continue breathing life to the property markets.

“For each of my clients, I spend a lot of time taking them through that process and at the end of it, they’re a lot savvier investors as opposed to someone who just came to a bank and got their loan,” he said.

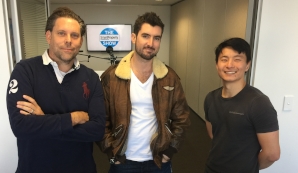

Michael shares with Smart Property Investment his property investment journey, which led to a successful career as a mortgage broker, and how he helps his clients craft their own paths towards success:

How does every day seem like in the life of Michael as a mortgage broker?

Michael Xia: Funnily enough, every Saturday, I’ve got three, four, five clients flying out from Sydney and we just go around looking for properties together… We just spend a whole day going through open homes.

Describe your client base.

Michael Xia: Majority of them came [from] a property forum… The initial client base was from that forum because I was quite active in sharing my story, the areas I’m buying, tips around that. After that, it just exploded through word of mouth.

It would be a broad range—I’ve got young investors in their early 20s and people all the way up to 65. It’s a broad mix. If there was a cross-section of your average Australian investor, I reckon most of them will be it.

Do you get more new investors or more experienced ones as clients?

Michael Xia: Some of them have invested before, and then there are some people that do want to invest but they see the Sydney property prices and they’re like, ‘This isn’t going to work,’ but they still want to do property investing, so they look at different areas.

How do you help property investors looking to invest in other areas?

Michael Xia: One thing that’s pretty common [in my clientele base] is it’s their first time buying interstate. For someone buying interstate for the first time, it’s actually quite daunting. I think having someone on the ground there that can guide them a little bit [is helpful] because the negotiation and the buying process is very, very different… Also in terms of how you work with the agents… it’s a little bit different again. It’s not quite like Sydney where I reckon you can throw a dart and you buy and you’re [always] going to do generally well… But in Brisbane, because population the population isn’t quite [as big], you need to be a little more pickier with your location.

I think all of those things put together, they need a fair bit of work just to learn the areas [where] to buy in Brisbane, then they will come up there and we’ll look at the properties together. In saying that, [however], even the process doesn’t take that long. I think the mechanical side of property investing, once you know it, you pick it up very quickly. It’s the emotional side of property investing that takes a little bit longer.

Has the transition from being a property investor to a mortgage broker been easy?

Michael Xia: It’s been difficult. Every week when I first started there were different sets of changes. When you were modelling out these property portfolios, what worked one week didn’t work the next week because of all these drastic changes.

How did you jump these hurdles and how did you go on to help investors, for a year now?

Michael Xia: The thing that helped me a lot was [that] I had a really good mentor who guided me through that process. He said, ‘Okay, because of [these] changes, these are the things that are possible.’ Once you’re in the industry every single day… you can definitely still build a decent portfolio with a certain limited income. It’s not nearly as much as it was before, but it can still definitely be done.

What is your main goal as a mortgage broker?

Michael Xia: My goal is… if I could make them a better investor and the properties that they’re buying are better, then, for their long-term financial goals, it’s going to get heaps better… For my business, it’s going to get better [as well]... For each of my clients, I spend a lot of time taking them through that process and at the end of it, they’re a lot savvier investors as opposed to someone who just came to a bank and got their loan.

Tune in to Michael Xia’s episode on The Smart Property Investment Show to know more about his portfolio, what the recent changes to the cash rate and bank interest rates actually mean for real-life investors, and some of the financial tips and tricks all property buyers should know.