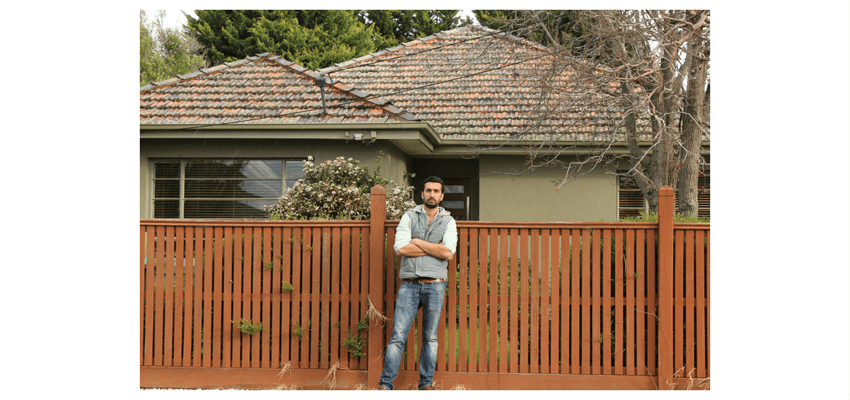

A property investment success story: How this migrant found home in Australia

Jazz Sidana moved to Melbourne from north India 12 years ago, starting his property investment journey shortly after getting an Information Technology (IT) job at a big retail company, driven only by his energy and motivation to succeed.

Around 10 years later, he proudly holds an impressive six-property portfolio and aims to increase its value by $5 million in the coming years.

“When I came, I barely had anything, so I think it’s possible for everybody,” he told Smart Property Investment.

The property investor shares the ups and downs of his journey and how he ultimately found home in Australia:

How did you begin your property investment journey?

I started from the pretty basics of working in IT as a junior support person and then moved my ranks up into development and development manager. So, property just happened... I don’t know how I got into the game of property.

I was actually planning to build my own house and one of the first things I did was [buy] a block of land. I think I had it almost for a year or two and I made decent money out of it. When I say decent money, it was only $20,000 to $30,000… I’m talking seven, eight years ago now. [Then] I decided to sell it just because of quick profit. I didn’t know anything about property investing at all back then… It just happened to start from there—where the love story started.

When did you realise the wealth creation opportunities in property?

I just had a natural love with property, for some reason… Not because I made $25,000 off my first block of land, but in general, I just travelled around looking at nice areas, nice boutique homes that have been built… That was just a natural interest that I had over there.

Then I started watching some of those shows, and that’s where it became a [true] investment journey rather than buying-a-display-home kind of thing, which is what a lot of people will end up doing when they see a display home. ‘Yeah, it's beautiful. Let's go and buy it.’ But from an investment perspective, it probably won’t stack up that well.

Did you live in Melbourne at that time you bought for the first time?

I was renting at the time, in Melbourne in the inner suburbs, Windsor area… I was planning to build my house and, obviously, [Melbourne's] inner city is pretty expensive, and then you're just starting your job where the salary is not that great, hence I started looking [in] outer suburbs.

I think, at the time of that block, [it was worth] $175,000… and I sold it for $20,000 profit after a year or two… My initial plan was to put my house on it.

Where did you buy your next properties?

Straight after that, I actually bought a house in the same area on a similar-sized block, in Barrack, and that I still hold to date, and it’s rented out currently… At the same time after buying that, I bought another property within the same area, just a corner block on a 600-square-metre, [which] I just hold to date… And that’s pretty much doubled in value, too, since then.

I bought again in the same area, Barrack area… This time, it was just a bigger house on a 20km, 30km block. And I'd rented my principal place of residence out... At the same time when I bought that, I ended up buying another one in Frankston within the same year… All the ones I bought except this particular one… can be subdivided—either knock down and put multiple units or can just subdivide and put one in the back in some cases.

I’m a very traditional-style investor—buying an old house on a block of land kind of thing, a decent-sized block which can be down the line something… So [I’m a] very, very traditional investor in [those] terms.

Why did you decide to follow this strategy?

My target was $5 million… in value… not in equity – that would be great.

The way I did was: I need to buy something that ... you can actually increase the value on it by putting granny flats, townhouses down the line … [This is] outer suburbs—the population grows over there … and they’re knocking out blocks, and just wanted blocks and putting multiple townhouses. That $5-million portfolio becomes $6 million or $7 million… depending on how many townhouses you put on it. That’s [the] down the line strategy… that’s how the portfolio has been built.

What do you hope your portfolio is going to do over time?

I’m a workaholic but I also do like [the] freedom to do whatever I feel like. For me, the part of building the portfolio is to be able to be financially free, but that doesn’t mean I want to stop working. I’m always going to keep working.

At the same time, maybe create an asset for being a migrant. People don’t even realise how lucky they are to be born over here and all. Being a migrant, you see all those things, the tough part of the life, and then you come here, and then it's tough once again. [But] if you do everything right, it makes your life a little bit easier.

For me, [it’s about creating] financial freedom, which I sort of already did now, and at the same time, leaving something for my family as well – for the kids. [Something] that they can grow in the future. Hopefully, not abuse it.

What’s your message for Australians who seem to be missing opportunities in their own country?

I wouldn’t say that, “What are you guys doing?” I mean, everyone’s got their own passion. Everyone’s lived their own life in their own way, but we shouldn’t say that life is tough over here. That’s the more important point. Life is actually very easy here. If you want a reality check, go somewhere in the countryside of India … then you compare it with over here, where you’re living next to the border, nice weather, there’s nothing to complain about, essentially. If you’re saying you’re struggling financially, then surely there’s something you’re not doing right over there; that’s 100 per cent true.

What would be your number one tip for new migrants in Australia?

Look, first of all, being a migrant, it’s not a disadvantage. It’s actually an advantage because you’ve already seen the hard side, and that’s why you’re leaving the country… Whoever thinks it’s a disadvantage is stupid to think that way.

Plus… there’s enough knowledge in the market right now, which is easily accessible through Facebook or podcasts or TV shows or property shows, whatever it is. You just need to find the right ones out, and that’s something you’ll only do if you actively want it on a daily basis. If you visit shows whenever they happen, if you listen to a podcast, eventually you’ll learn what’s the right one and what’s the wrong one.

Real estate, it’s already at its peak right now in Melbourne and Sydney, but there [are] other states you can go to, so there’s hardly anything that can go wrong when there’s an influx of migrants coming in. [Baby Boomers are] sitting in right now, so as the influx of migrants [comes] in, the first thing they’re going to look for is a house to live in. So if you’ve bought in the right place, in the outer suburbs, which is where they’ll be able to afford because they want to still commute to work, there’s not that much that can go wrong.

Tune in to Jazz Sidana’s episode on The Smart Property Investment Show to know more about how to figure out whether an investment is good, how to add the most value to your portfolio, and the differences between non-major lenders and major banks.