Brisbane Property Market Update – July 2020

There is so much variation in what is going on around Australia right now. The Brisbane market is proving its resilience yet again, compared with other capital city markets during the current pandemic, writes Melinda Jennison.

Let’s take a look at some the data and some of our real-time observations to summarise what is happening in the Brisbane housing market and also the Brisbane unit market right now.

Brisbane property market prices

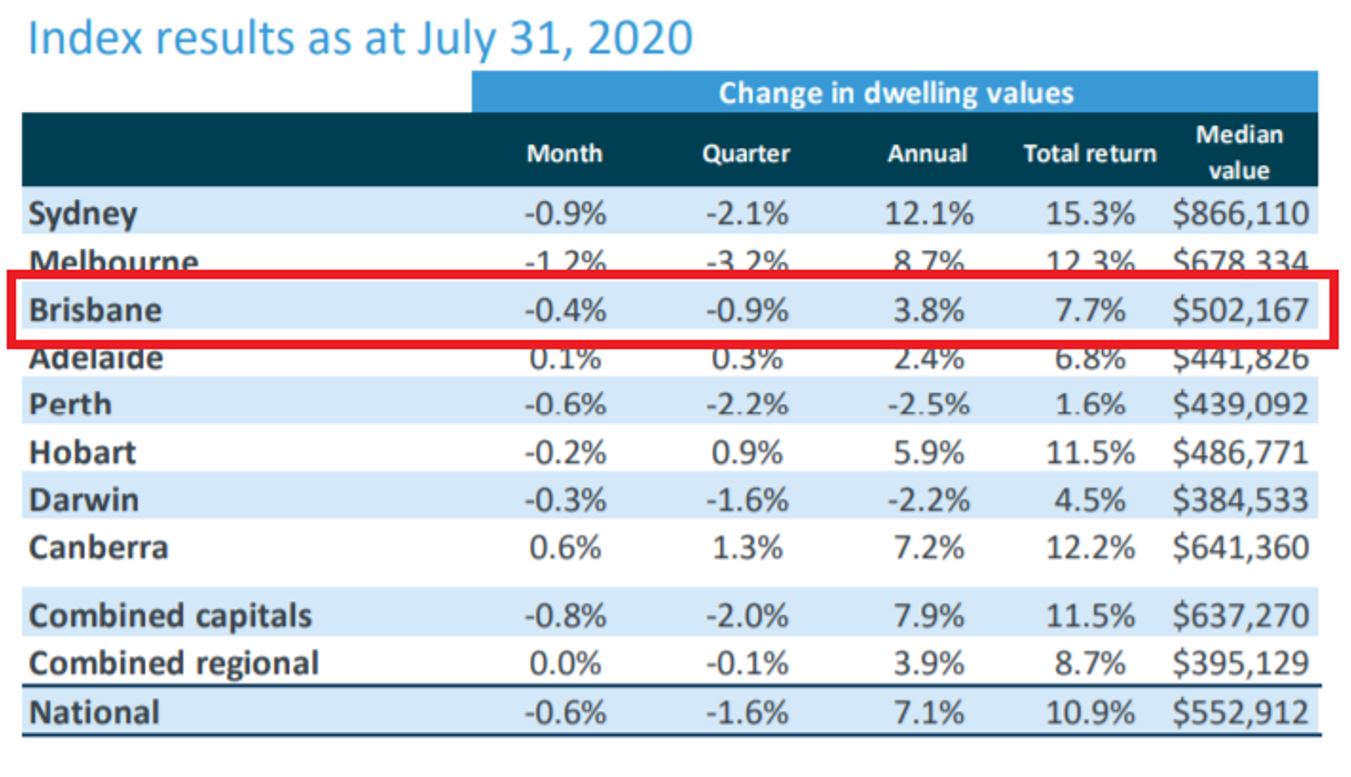

According to the latest Hedonic Home Value Index data by Corelogic, dwelling values in Brisbane saw a -0.4 per cent decline in value over the month of July 2020.

While the broader data shows some slight falls in dwelling values across the month and the quarter, the Brisbane market has proven its resilience to more widespread price falls.

Of course, there are many things in place supporting all property markets around the country. Record-low interest rates make borrowing very easy for those with secure jobs and good incomes. The record levels of government support and also the repayment holidays for distressed borrowers also help to insulate any immediate impact on property values. Additionally, the federal and state government incentives for first home buyers has increased demand for that group of buyers across the country.

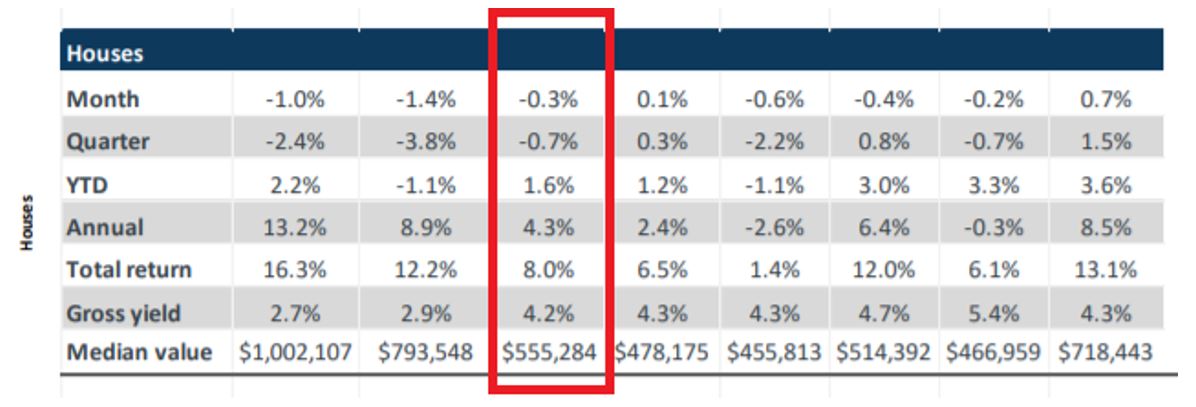

In the Brisbane housing market, we saw median values for the greater Brisbane region fall -0.3 per cent across the month of July 2020. The current median value for a Brisbane house is now $555,284.

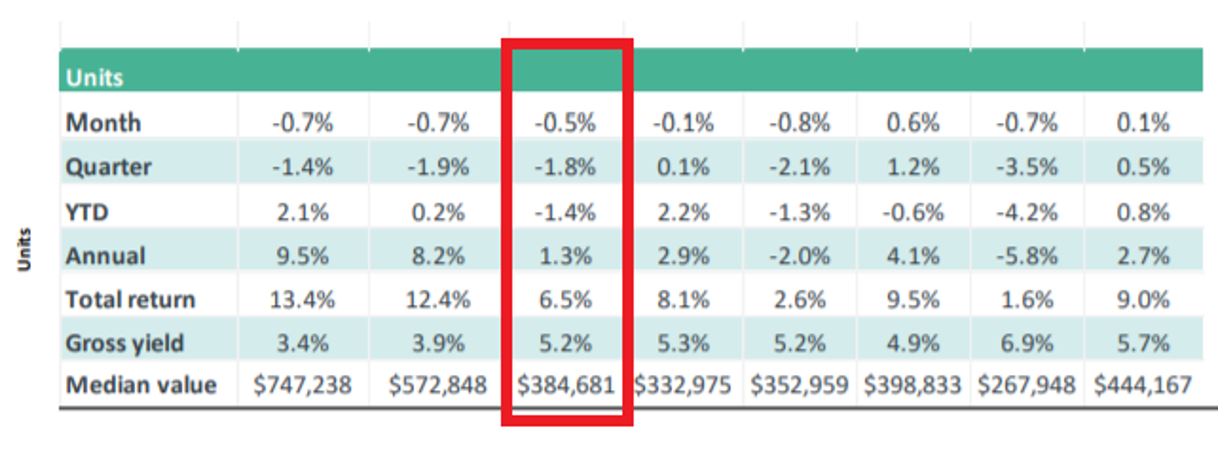

The unit market in Brisbane saw a slightly higher median value decline of -0.5 per cent for the month of July 2020. The current unit price in Brisbane is now $384,681.

What is happening in the rental market in Brisbane?

At a city level, the rental market in Brisbane has definitely recovered, although there are still some at risk markets around our city.

In short, the vacancy rate in many locations is trending down and is very tight. The areas where this trend is not happening are in the Brisbane CBD and locations immediately surrounding this and also in areas where there are a lot of higher-density unit developments. In these locations, vacancy is still a big problem. Therefore, these markets remain high-risk.

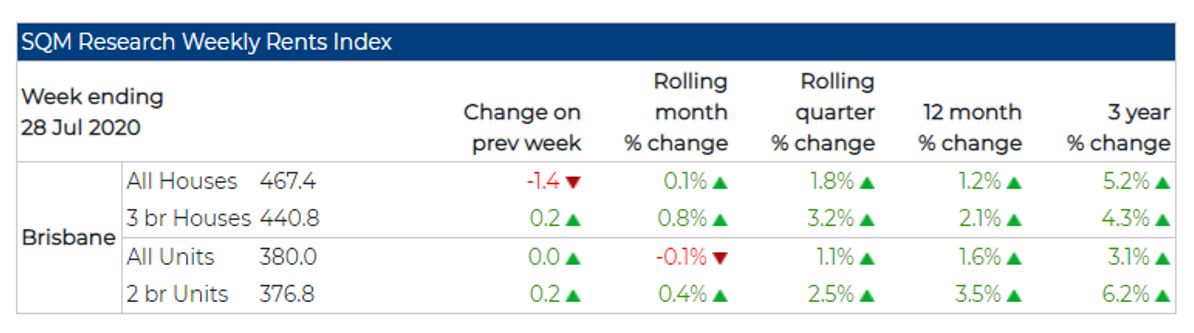

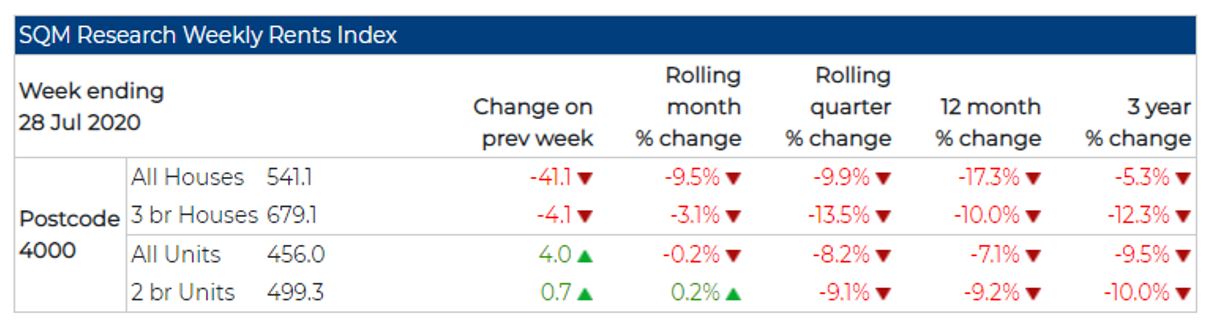

Asking rents according to SQM Research across the city have also been trending higher, so this is also reassuring for property investors.

That said, Brisbane is not one property market and caution definitely needs to be taken when looking at a postcode level. You will see in the Brisbane CBD, for example, the situation is VERY different.

What are we seeing on the ground across Brisbane?

In our opinion, the data above may be slightly misleading based on our on-the-ground observations. Despite the overall median data trend showing very slight falls in house values, we are in fact seeing quality housing in very high demand. Some open homes we have attended over the month of July have seen more than 30-40 groups through. This illustrates that buyers are still very active in the Brisbane property market.

Advertised properties that are listed for sale in desirable locations are being sold very quickly in Brisbane. Often, the sale is a result of multiple offers being submitted on the property. If listed for sale by auction, they are achieving high prices with multiple registered bidders.

There are markets within markets, and we are seeing strong prices being paid for quality properties in many regions around our city. In the most recent Herron Todd White Month in Review, it is confirmed that the coronavirus crisis has not resulted in a measurable fall in property prices across Brisbane, so buyers should not expect a bargain due to the pandemic. They also confirm that many properties are trading off-market, which is a trend we are seeing also.

How does the Brisbane property market compare with other capital cities around Australia?

Melbourne and Sydney are leading the decline in capital city values. Melbourne recorded a -1.2 per cent fall in dwelling values across the month, whereas Sydney saw a fall of -0.9 per cent in dwelling values for July 2020.

This is certainly now surprising, given the recent second wave of coronavirus cases in Melbourne. This has now resulted in stage 4 restrictions with the Victorian state government’s recent announcement.

This has impacted on consumer sentiment, with readings from the ANZ-Roy Morgan Consumer Confidence Rating weakening throughout July, despite the huge recovery from the April lows. This index shows a high correlation with housing market activity (not prices). The recent downturn might therefore suggest that buyers and sellers may once again retreat to the sidelines.

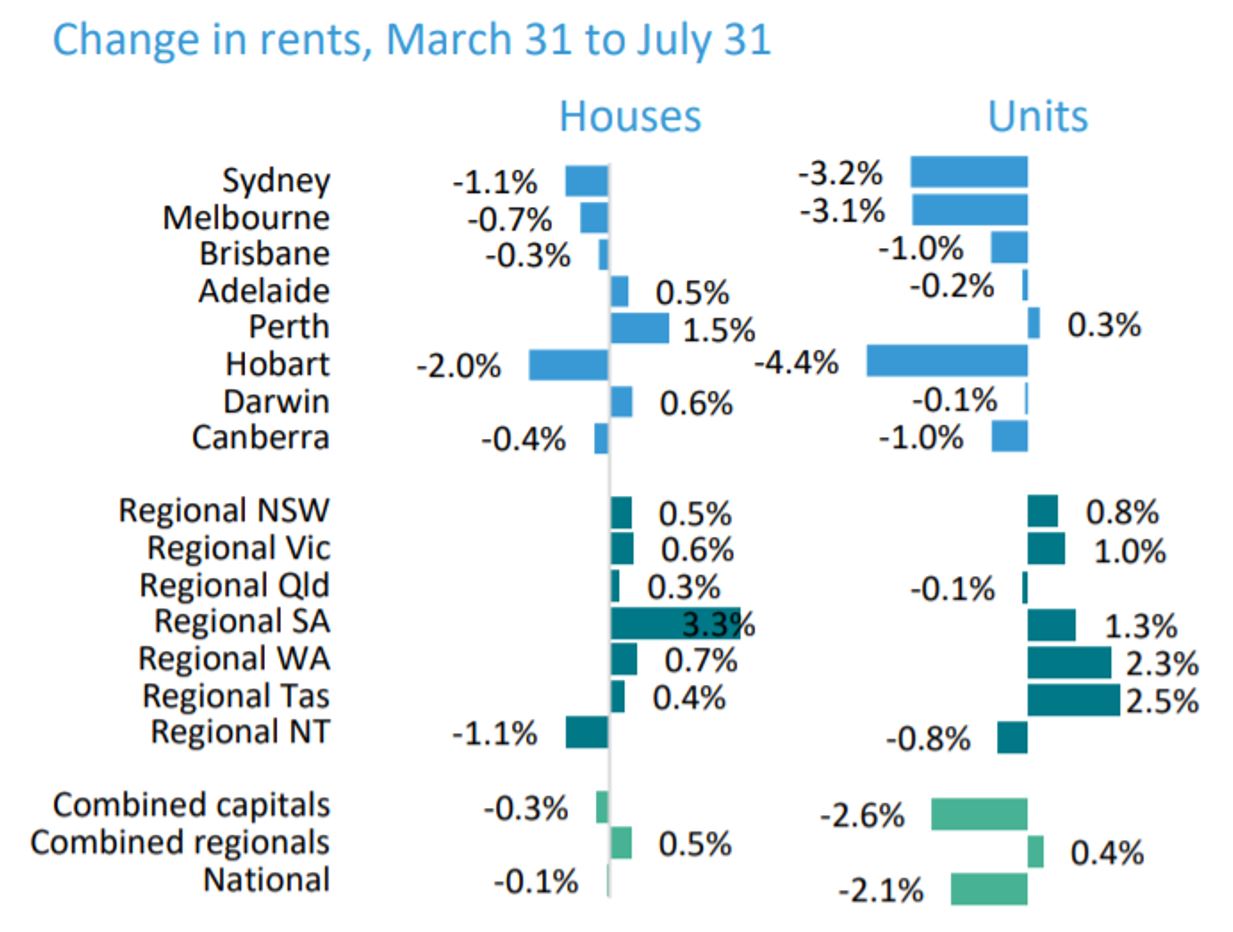

In terms of changes in rent, Brisbane is doing well compared with other capital cities. The weakest rental conditions are being experienced in Hobart (house rents down -2 per cent and units down -4.5 per cent since March), Sydney (house rents down -1.1 per cent and units down -3.2 per cent) and Melbourne (house rents down -0.7 per cent and units down -3.1 per cent). It is important to mention that the weaker rental conditions are larger in the unit markets, compared with the housing markets in these cities.

What’s going to happen to the Brisbane property market moving forward?

There is a lot of worry and concern about what might happen to property values across the country when the government’s fiscal response starts to taper in October and repayment holidays expire at the end of March next year. Of course, we may see a rise in distressed properties coming to the market. What we do not know is if this will put any downward pressure on prices. This is where I think the different property markets around Australia will each experience something slightly different.

According to the Commonwealth Bank Home Buying Spending Intentions Index, there was a 6 per cent rise in home buying intentions nationally up to the end of June 2020. This index showed the index had returned back close to levels seen in March – after much weaker readings in April and May.

We are definitely seeing this trend on the ground with the current high volume of buyers in Brisbane. Because of this, I’m sure we could see some moderate increase in new listings come to the market without any significant impact on the supply and demand balance. Remember, property prices will only fall when supply outstrips demand.

With dwelling approvals now at the lowest level in eight years, the future supply pipeline also looks tight. The most recent Australian Bureau of Statistics data showed a decline of -10.9 per cent in new detached house approvals in Queensland.

Real-time demand is still strong and Brisbane property buyers are being fuelled by the lowest-ever interest rates, good levels of affordability and strong rental yields compared with many other state capitals. This is good news for our local Brisbane property market, and these factors will continue to support our property values into the future.