What is the first sign of a heating market?

Property investors are being advised to look at the rental market as a sign of desirability as it is often the first sign of a growing market.

In a conversation with Smart Property Investment, InvestorKit’s head of research, Arjun Paliwal, said: “Rental demand is the truest form of demand because people don’t go in competing for a rental property hoping for rents to go up.”

“Behind every reason to buy, whether it’s an owner-occupier or an investor buying, they share one element: I hope this product goes up in value,” he said.

“But when rental markets show drastic changes, that is a clear display of demand where people want to live in an area immediately.”

Mr Paliwal pointed out that during difficult times, it is crucial for investors to be able to hold onto the property, with buying in a region experiencing a growth in rental demand likely to offset some of the risk.

“Buying in these regions can help investors reduce the risk throughout their journey because of the strengthening rental market and low stock. But it’s important for people to know that within the region, properties will have various performing levels,” Mr Paliwal said.

The Brisbane region

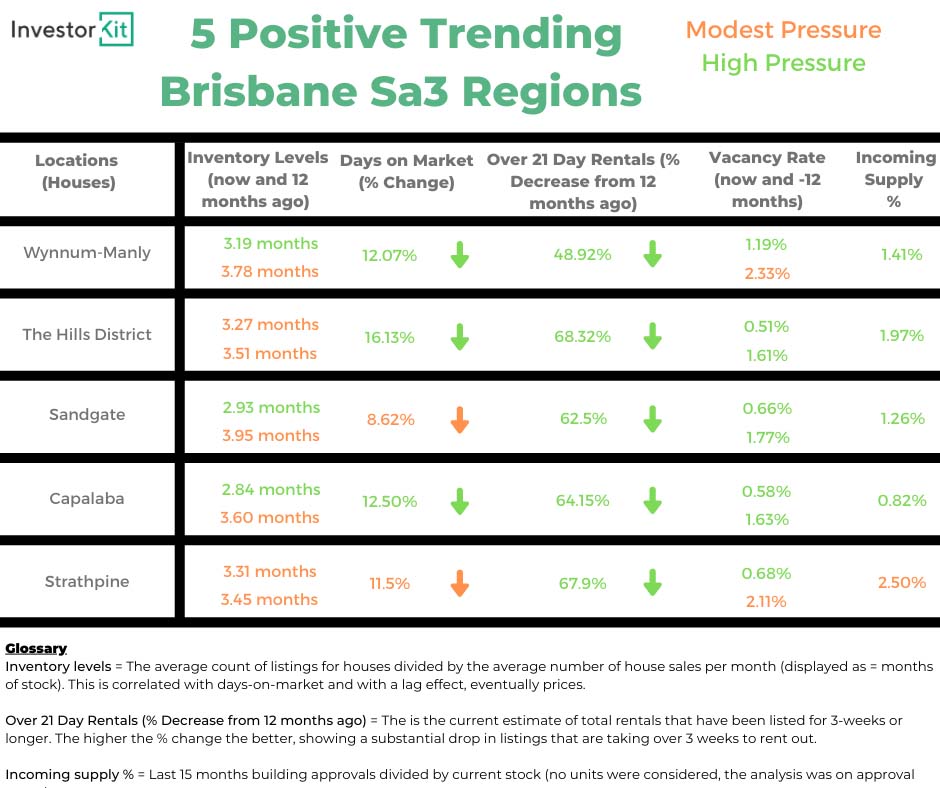

Mr Paliwal highlighted this by showing five sa3 regions that are showing signs of growth in the Brisbane area.

“The five Brisbane regions are Wynnum-Manly, The Hills District, Sandgate, Capalaba and Strathpine,” Mr Paliwal said.

“These five sa3 Brisbane regions are displaying changing trends of lowering stock at healthy or low levels.

“They are displaying far less properties that take more than 21 days to rent out. They are displaying tightening vacancy rates, and they all have below 3 per cent of building approvals in the pipeline, Mr Paliwal said.

The researcher pointed out the lack of supply in the area is likely to help drive the price of rental yields in these properties.

“It’s a balance between affordability and a lack of choice due to supply,” Mr Paliwal said.

“They are all primarily house markets, so the vacancy rates are staying balanced because they aren’t full of units,” Mr Paliwal said.

However, he warned investors against falling into the trap of expecting the entire city to be growing.

“They are located middle-north, east, middle-south and north-west,” Mr Paliwal said.

“But not everywhere [is showing signs of rental growth]. There’s still various other regions that are displaying increasing levels of stock supply and vacancy rates staying elevated. But these are the five regions that stand out,” Mr Paliwal said.