Could Australian property follow NZ’s lead?

InvestorKit’s head of research, Arjun Paliwal, told Smart Property Investment that record-low interest rates, consumer confidence and disposable income usually reserved for travel are helping guide the New Zealand property market forward.

“Over the past year, September to September, New Zealand house prices have moved up by over 14 per cent,” Mr Paliwal said.

“The commentators in New Zealand are talking about the impact of low interest rates, removal of loan-to-value ratio restrictions and the impact of people having fears of being priced out in the future.”

Mr Paliwal explained how New Zealand being a world leader on the COVID-19 pandemic is helping its property market.

“New Zealand has a high level of confidence given how they handled COVID compared with the rest of the world as well as a somewhat return to normality,” the researcher said.

While investors and owner-occupiers are confident to enter the market, they are facing a shortage of supply which is further driving up the prices of New Zealand houses.

“There’s a very low level of supply in New Zealand from an available land to low levels of construction,” he said.

While highlighting New Zealand’s strengths, the researcher pointed to the similarities between the New Zealand and Australian housing markets.

“If you bring it back to an Australian space. Does Australia have low interest rates? Yes, ours are lower.

“Does Australia have improved loan-to-value ratios? Yes, we have up to 90 to 95 LVRs, which is getting stronger because of government support for first home buyers.”

“Do Australian buyers have a fear of being priced out? I believe this is starting, we are starting to see high attendance at open homes despite low stock.”

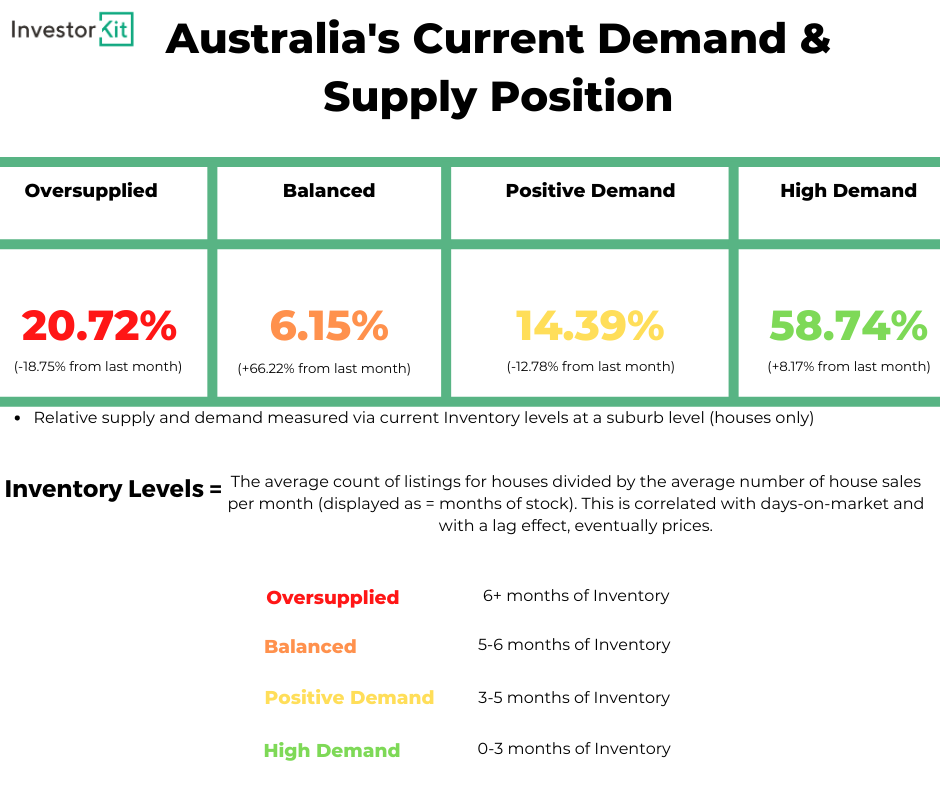

“Now, do we have low supply? Overall, Australia does with building approvals dropping substantially over the last few years and with the current supply on market most of Australia is seeing low interest levels,” Mr Paliwal explained.

However, the researcher noted one key difference that is holding the Australian market back.

“The only difference is fully across New Zealand there’s an increased level of sentiment due to the handling of the COVID-19 pandemic.

“In Australia, there are increased levels of sentiment but not at the same levels to New Zealand, which can be attributed to Victoria’s lockdown and border closures,” the researcher noted.

Mr Paliwal believes that if the government can successfully handle future outbreaks of COVID-19 that Australia’s market could follow New Zealand’s.

“If we get to a moment where the states are opening up, and people being able to move where they want to, then we may see some of our regions – particularly sea change, tree change and affordable markets – really start to continue their momentum,” Mr Paliwal concluded.