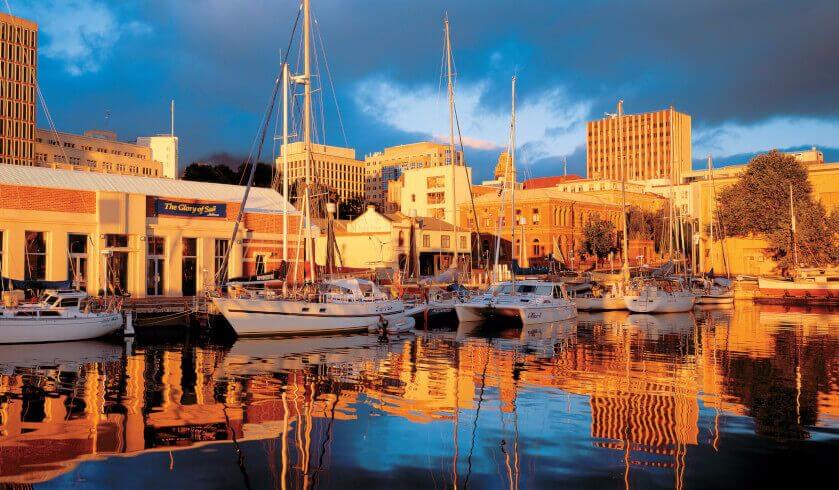

Is it too late to enter the Hobart property market?

The capital city of Hobart was tagged recently as one of the hottest property markets in Australia—with investors flocking into the area within the past years. But are there still opportunities left for those who have yet to enter Tasmania’s capital?

As only the 11th biggest city in the country, some argue disparagingly that Hobart is better described as being among the country's regional markets. But Propertyology’s Simon Pressley argues instead that the city has the fundamentals and growth drivers that can be found in all of the primary metropolitan markets, including consistent price growth and good yields.

Since 2014, Tasmania slowly emerged as one of the biggest economies in Australia even after experiencing a state recession.

Consequently, Hobart has been identified by a lot of experts as a solid market where investors can pick up good properties—where properties can go up in value without costing too much to hold.

Mr Pressley said: “Between early 2014 and early 2016, the market was flat for most of that, so we were able to take advantage of picking the best properties. We negotiated some pretty good discounts off list prices. When you're in a flat market, that you're not competing against anybody.”

“We backed our judgement that the economy is going to improve. We picked it by focusing our research and understanding property economics more so than property data. The economy did improve during that two-year period,” he highlighted.

Should investors instead move on and find the ‘next Hobart’?

Stay, but don’t buy anymore

According to the buyer’s agent, it’s undeniably harder to buy properties in the city largely due to the increase of investment activity.

Suddenly, properties that were listed for sale are being sold rather quickly to investors who are willing to pay over the odds—a sign that the market’s only getting hotter.

While a flat market benefits the buyer, a hot market benefits those already in the market.

As a buyer’s agent, Mr Pressley knows that his time in Hobart is up because of the increasing scarcity of good deals—but by no means is the market done providing good returns to investors.

In fact, those they have helped buy in Hobart four years ago have already seen 30 to 40 per cent growth.

Moreover as of April 2018, rents have grown by 25 per cent, holding costs remain low and most properties have become cash flow positive in the past 12 months. Vacancy rates are also at an all-time low of about 0.3 per cent.

According to Mr Pressley, Hobart could easily be the biggest Australian property market success story in 20 years.

He said: “It is hotter now than what it has ever been. That is really exciting and, I'd say, rare for property investors. The economy is really solid.”

“There's a lot of really exciting infrastructure projects there. Agriculture's going crazy, tourism's going crazy. International student market is really, really big.”

“Now, every market will come to an end at some point, but we can't see the end of Hobart yet. It will be out there somewhere, but it certainly won't be 2018,” the buyer’s agent added.

Moving forward, investors in Hobart may experience up to 20 per cent growth in 2018—as strong as the growth seen in Sydney and Melbourne during their four-year boom.

Growth drivers

Local buyers' confidence

Considering the positive movements of the Hobart market, you’d think that it’s filled with sophisticated investors creating wealth. According to Mr Pressley, one of the unexpected secrets of the city is its local buyers.

In the past 12 months, only 25 per cent of transactions in the city were concluded with investors, which is a stark contrast to Sydney and Melbourne’s 50 to 60 per cent investors’ transactions.

The buyer’s agent said that the local investment activity makes the market more sustainable.

Mr Pressley explained: “When you're got owner-occupiers transacting, whether it's a first home buyer or an existing owner-occupier upgrading, that is a really sustainable market since it's local sentiment that's driving that, it's local confidence.”

If local confidence is strong, it means people are sticking around. The more people thriving in a community, the stronger the economy gets.

The buyer’s agent said: “It means people are happy to be upgrading their property and maybe even buying more expensive property. They're pretty happy with where they sit and confident that the state government will maintain growth—it’s all property economics.”

“More and more people are relocating and that's providing a very solid floor for that property market,” he highlighted.

Undersupply of dwellings

Aside from local confidence, the undersupply of dwellings is also among the growth drivers present in the city.

Building approval volumes in the city remain low, according to Mr Pressley. In general, it takes no less than 18 months and up to two years to have a dwelling built after it’s development application is approved.

Moreover, the strict height restrictions in Hobart prevents the rise of high-density living that are prevalent in other capital cities.

Mr Pressley believes that supply will most likely remain tight in the next couple of years resulting in a positive pressure on price growth.

It’s not too late, but ...

In general, there are lots of opportunities for investors in Hobart, but those who want to get into the market need to be realistic about their expectations.

The city’s property market is red hot: if you are looking to negotiate for big discounts, you’d be likely to get outbid by 20 other potential buyers in a snap.

According to Mr Pressley, if the years 2014 to 2016 allowed their agency to buy around 100 properties across Hobart, it could now take no less than six months to get into the market.

His advice for investors willing to take the risk: Do your due diligence.

The buyer’s agent said: “You need to do your due diligence, whether you go there and do it yourself or you pay someone else to do it.”

“Everyone's circumstance is different and where you invest, how you invest and the timing of your investment and how big your portfolio gets depends on the decisions you make today and where you want to go in the future,” he concluded.

Tune in to Simon Pressley’s property markets update on The Smart Property Investment Show to know more about the current state of markets across Australia.