Houses versus units – Which has better growth prospects?

In running some residex reports for a client recently, I started to see a pattern that I wanted to share.

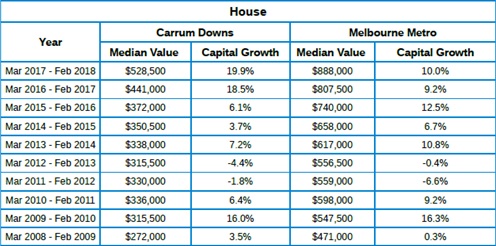

In looking at the suburb report for Carrum Downs, a suburb of Melbourne as an example, where houses have performed better than units over the past 10 years with capital growth on a house of $256,000 versus $160,500 on a unit.

Historical house statistics for Carrum Downs 3201

Capital growth

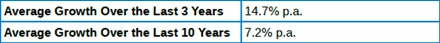

Historical unit statistics for Carrum Downs 3201

Capital growth

Did you notice the gap between houses and units in February 2009? We see this was very small at only $21,000. But if we now look at the gap between houses and units by 2017 we see this widening out to $117,500.

For potential purchasers in the Carrum Downs area, a rise in the value of units could correlate to a higher number of units being sold.

In running further reports on large regional areas I started to see towns where units were performing very similar or in some instances better than houses.

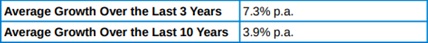

If we look at Horsham in Victoria as an example, we see that units have performed better than houses by $8,500.

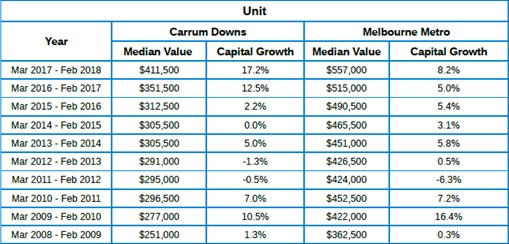

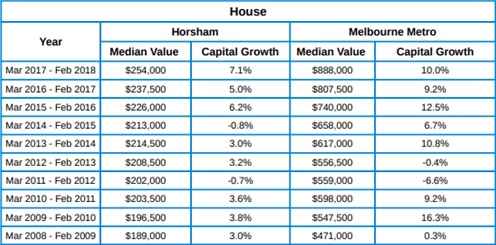

Historical house statistics for Horsham 3400

Capital growth

What we see is that in 2009 the median house price was $189,000 and for units this was $160,500 with the difference of $28,500, being similar to the price difference we saw in Carrum Downs.

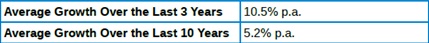

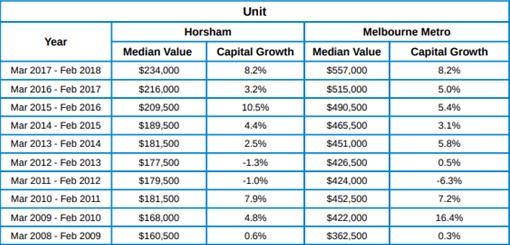

Historical house statistics for units 3400

Capital growth

The difference is that units have grown by $73,500 over 10 years with houses growing over the same period by $65,000 and continuing at similar price points.

The biggest difference with the units versus houses comparison as an investment property is in holding costs as units will often have owners corporation fees to include and this may take what seems like a good deal to something that will drain your hip pocket.

I know that I have seen clients looking at deals with owners corporation fees blowing out to $10,000 per year; this will put a big hole in your cashflow.

With the right due diligence however, you could find a unit which has no owners corporation fees.

How, I hear you ask? On a strata titled corner block with no adjoining walls and no common land with only two on the block, there would be no owners corporation fee required. So, depending on the area that you are looking to purchase in, review how units are performing compared to houses, as units may make a perfect fit to your portfolio.