How this couple deals with conflict to grow their portfolio

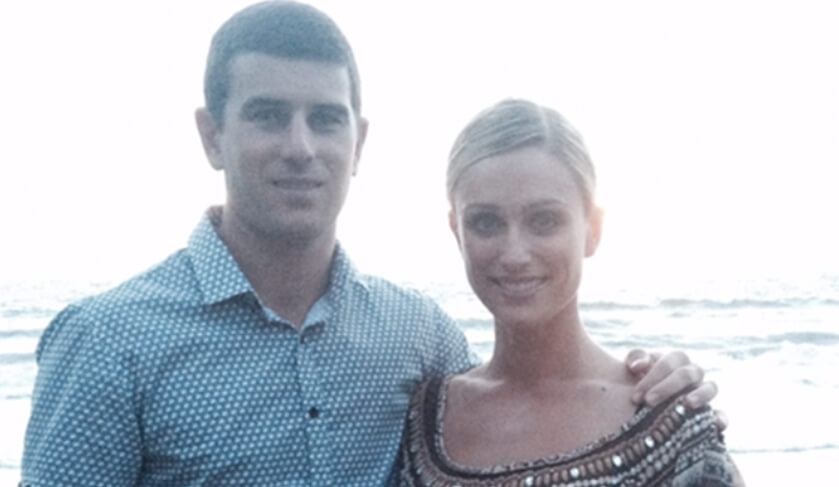

Husband and wife team Brendon and Courtney join Phil to share how they made the transition from buying somewhere just to live in to becoming so well-versed in the market, that sometimes they need to tone down the property talk before they begin picking a fight with their friends or with each other.

Courtney explains how her negotiation skills and her drive to educate herself has enabled the success of their portfolio, while Brendon discusses how his government job has helped with bank loans.

We also hear about what they have learnt through each property they bought and how it has impacted each purchase.

You will also find out what happens when you rely on a bad mortgage broke, why an investment couple needs a “pusher" and how they balance their different views.

You'll hear all of this and more, in this episode of The Smart Property Investment Show!

Make sure you never miss an episode by subscribing to us now on iTunes!

If you liked this episode, show your support by rating us or leaving a review on iTunes (The Smart Property Investment Show) and by following Smart Property Investment on social media: Facebook, Twitter and LinkedIn. If you have any questions about what you heard today, any topics of interest you have in mind, or if you’d like to lend your voice to the show, email [email protected] for more insight!

Suburbs mentioned in this episode:

Sydney

Menai

Queensland

Brisbane

Beenleigh

Eagleby

Deception Bay

Petrie

Werribee

Moreton Bay

Melbourne

Surry Hills

Related articles of interest:

Why this investor is comfortable about not seeing her purchases

Should a real estate title be in one person’s name only?

How to negotiate for the price you want