LJ Hooker shares tips for ACT market after 18% gains in 2018

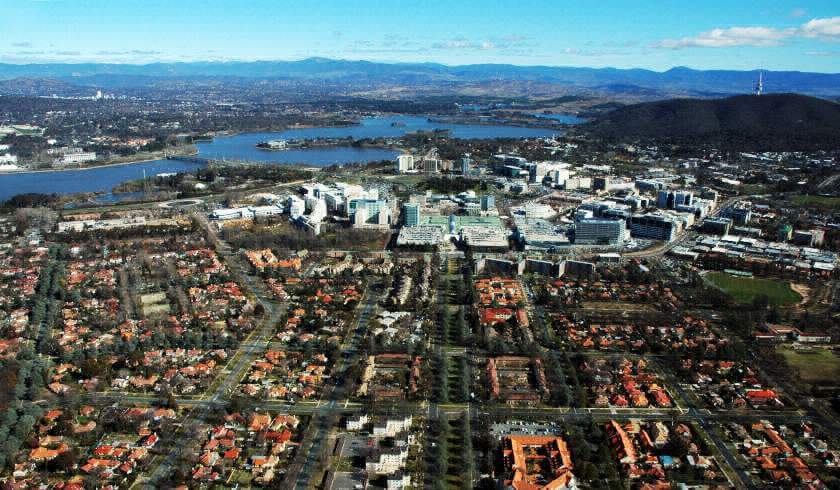

Although the policies of a changing government can impact on a property market, the ACT – home of the federal government – has seen positive growth, according to Mathew Tiller, head of research at LJ Hooker, who estimates prices are up between 4 to 5 per cent.

A number of factors have contributed to this strong market, which include both population growth and employment, Mr Tiller said.

“Population growth has been pretty strong in ACT. I think it’s running at the moment around 2 per cent or so, which obviously is very strong, especially for such a small population for a territory like the ACT,” he said.

“In terms of sectors, the housing market has obviously outperformed unit markets given that there’s been a lot of unit supply into that area, but investors have looked at affordability of the ACT market compared to what’s happened in Melbourne and Sydney.”

Over the last year, Mr Tiller's top pick for price growth in the territory was Torrens houses, which grew 17.8 per cent up to $800,000, followed by Isabella Plains which grew 14.2 per cent up to $574,000, and then Chapman, which grew 12 per cent up to $837,000.

Up until the upcoming federal election, Mr Tiller said the market is expected to remain flat due to the uncertainty.

However, with a change of government looking likely, the research head said the public service sector could see a changeover in the new year, which would mean new public service workers would need to come in, which would then raise demand.

“If there’s a change in government generally, especially the Labor government, ... spending on public service generally goes up and obviously again, that fuels population, employment, and spending on housing, so it's really just going to boil down to what happens at the federal election,” Mr Tiller said.

Depending on what policies the federal government introduces after the election, along with the recommendations made at the conclusion of the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry, Mr Tiller also said there is also a possibility of a softening market.

“The change of government and how the policies change, and the investor demands softened in along with those policy changes and any restrictions that the banks come and enforce from the end of the royal commission – then investor demands may lead to a softening in the market,” he said.