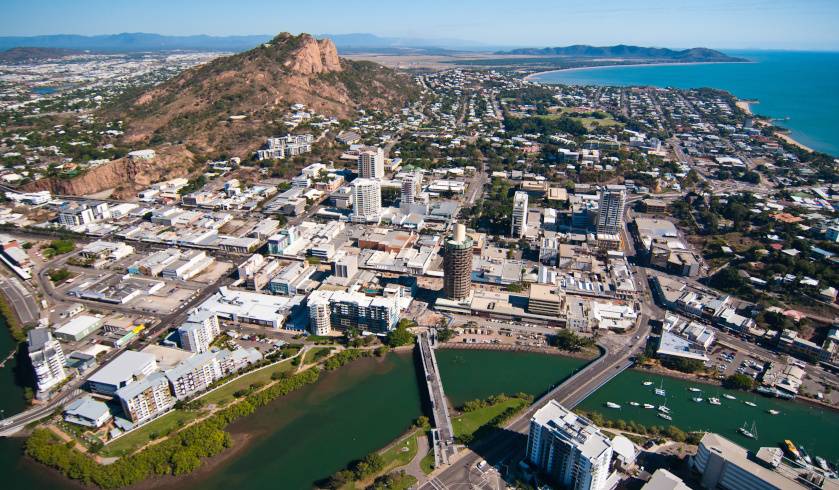

The state of commercial in FNQ

According to Explore Property Commercial’s latest Commercial Real Estate Leasing Report, the impacts became clearer in the month of March.

“In the first full month of lockdown conditions, our leasing research identified just 12 deals being completed [in Townsville] in the month,” the report said.

“March 2020 saw a total of 2,390 square metres leased in the Townsville region – this is a decline of 76 per cent over the previous month and 77 per cent lower than the FY20 to date average.

“The industrial sector continues to dominate transactions in Townsville, with 1,184 square metres of space leased.”

Vacancy rates

The report also looked into how long commercial real estate vacancy rates in Townsville.

“Premises leased in March 2020 had experienced an average of 12 months of vacancy, which translated into a vacancy expense of $30,212 per tenancy,” the report said.

“We have been reporting on the shortage of quality leasing opportunities in the Townsville city fringe for some time, particularly in the industrial space.

“The March 2020 result shows this trend continuing with premises on the market for less than two years dominating the deals being done.

“Despite these mounting losses and extended vacancy periods, we are still not seeing significant redevelopment of long vacant sites.”

Current supply

When it comes to the current supply in Townsville, the report found that low vacancy and low absorption indicated a stagnating commercial real estate sector even before the COVID-19 pandemic.

“With a negative absorption figure recorded this month, it is not possible to calculate the number of months’ supply that this total vacancy figure represents,” it said.

“However, the vacancy rate of 5.3 per cent is a very low figure and constrains sustainable economic growth. We were regularly hearing of businesses unwilling to commit to expansion because of the lack of accommodation alternatives available in the market.

“But on the other side of the equation, developers have insufficient balance sheet strength to build without pre-commitment.

“While this stand-off creates short-term gains for investors, the longer-term result will be a loss of competitive advantage for Townsville as other regional locations provide better business accommodation.”