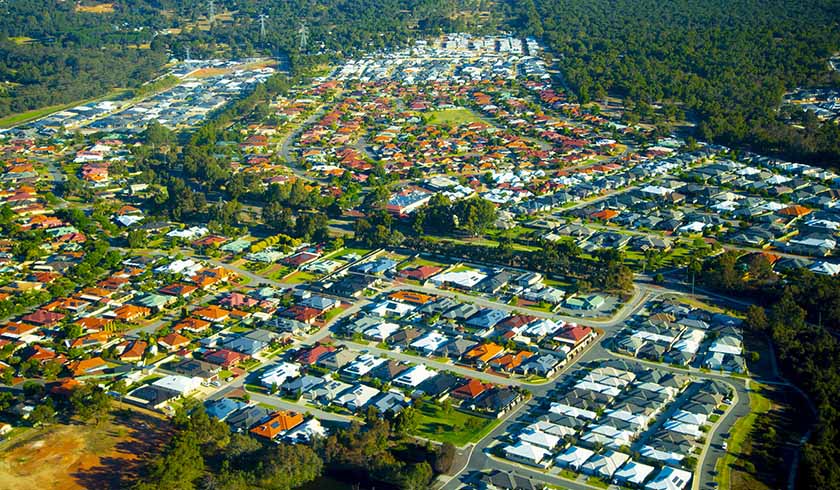

Affordability and improving rental yields key drawcards in Perth appeal

WA-based property investment consultancy Momentum Wealth has shone a spotlight on why the Perth market is seeing a 40 per cent rise in buyer activity year-on-year.

New research by the Real Estate Institute of Western Australia (REIWA) has found that buyer activity in Perth is tracking 40 per cent higher annually. Further, the data shows that 45 per cent of Perth suburbs recorded price growth in August 2020, with local buyers agents noting high attendance at home opens.

Commenting on the stats, chair of Momentum Wealth’s residential investment committee, Emma Everett, said affordability and improving rental yields are presenting a drawcard for investors.

Ms Everett noted that data from the REIWA showed there were only 10,686 properties listed for sale across Perth in the week ending 20 September – a decline of 23 per cent from the same period in 2019.

“At the same time, Perth has recorded a sustained increase in buyer activity in the months following the easing of COVID-19 restrictions, with sales activity trending 40 per cent higher in August compared to the same period in 2019, which is putting further downwards pressure on stock levels.

“These conditions are translating into an increasingly competitive market as buyers in high-demand areas compete for a reducing pool of properties, with our buyer’s agents regularly noting higher attendance at home opens and multiple offers from buyers for high-quality stock in our preferred suburbs.”

What are the hotspots?

According to Ms Everett, the aforementioned stat – which found that 45 per cent of Perth suburbs recorded price growth in August 2020 – is a clear indication of improved conditions.

“While yet to flow through into resumed headline price growth, these conditions, combined with suburb-specific demand and supply factors, have already translated into improvements across a number of market segments in Perth, with REIWA reporting that 45 per cent of suburbs in the western capital experienced increases in median sales price across August,” she said, noting that this was “particularly evident in suburbs where tightening stock levels and limited oncoming supply had been accompanied by strong demand signals from buyers”.

“While the average days on market for properties in the Greater Perth region was 50 days in the three months to June 2020, we’ve seen other areas record days on market as low as 20 across the same period, particularly where these tightening stock levels have been accompanied by high online property views,” Ms Everett explained.

REIWA data shows Kingsley, Beldon and Mouth Hawthorn were among a number of suburbs to outperform the broader market for both days on market and median sales price, with the suburbs recording price increases of 6.3 per cent, 4.0 per cent and 6.3 per cent, respectively, for houses in the year to June 2020.

Meanwhile, the median sales price in Greater Perth declined 3.1 per cent across the same period, according to the REIWA.

Looking to buy?

Ms Everett shared that while activity in the Perth market remains primarily owner-occupier driven, “savvy investors” are already turning their attention to the WA capital.

“As it stands, these improvements are primarily being driven by owner-occupiers and first home buyers; however, we are starting to see interest from investors who recognise that conditions are ripening and the market is already moving, and we expect it’s only a matter of time until others follow suit, particularly once we see broader rental growth,” she said.

“Perth’s relative affordability, improving rental conditions and early growth indicators are providing ideal conditions for investors with the right property selection criteria to enter the market at a reasonable price point and at a strong yield while positioning themselves to leverage future market improvements.”

Commenting further, Momentum Wealth’s property management team leader, Amanda Kroczek, said:

“With rental vacancy rates reaching a 12-year low in Perth and rental stock continuing to tighten, our property managers have seen a significant rise in tenant competition on the ground, which in many cases is resulting in rent increases for advertised properties as tenants are offering more to secure their property of choice.”